Blockchain is going to disrupt the current financial system.

If you are not a trader and understand the mission of the Cardano project then maybe you will stop caring about the short-term price fluctuation. We do not want to speculate about the price without facts and fundamentals. We would like to present the mission of the project and then try to estimate the price if the goal will be achieved. It is a difficult task since nobody is able to ensure the success of the project and there will be a lot of obstacles on the way.

How our social and financial interactions work

Our lives are based on interaction with friends, companies, institutions, banks, and services that are provided by global companies. People communicate with people. Companies with other companies or banks. There are a plethora of possible interconnections. The number grows every year as the digitalization of the world rises. Thus a big amount of all these interactions takes place on the Internet. There are a huge amount of transactions that are related to payments, shopping, entertainment, chatting, business, etc. Internet communication is realized via transactions on different protocols. The current problem of the world is that we use many middlemen for various reasons. For example, we use banks as a middleman for two major reasons. The first reason is that banks offer a service that allows us to create an account. We can use the account number and provide it to someone who wants to send us fiat currency. It is a useful solution when there is a long physical distance between participants of the transaction. The second reason is the ability of banks to ensure trust between two entities that do not trust each other. Everybody can choose their own bank to which he or she trusts. We use a lot of internet services that allow us to buy goods, consumer entertainment, and spend time on social networks. We trust big companies like Amazon, Facebook, Google, Twitter, etc. Believe it or not, these companies have a lot of information about us and are able to commercialize the data.

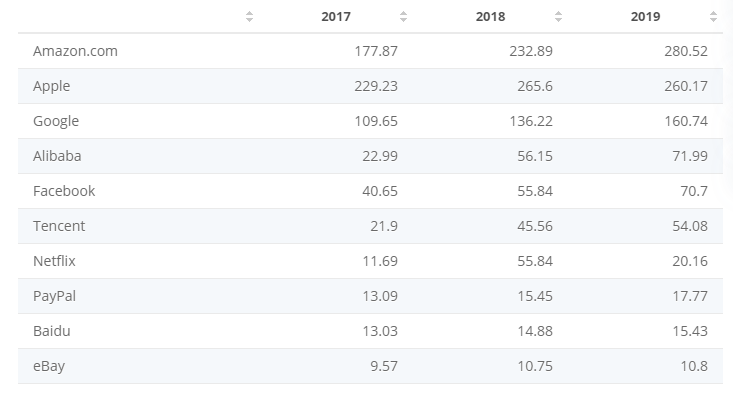

Banks require us to know our real identities. The same is often true for social and e-commerce platforms. People have to provide a real name and address when a good is to be delivered to them. Even if we do not provide our real identity we have a kind of account within social networks that can be connected to our activities and social interactions. We tend to use platforms that are used by many people. People are social by nature and there are many hobby groups on Facebook where people want to share their opinions. That’s why we often forget privacy when we use platforms like Facebook. Big IT companies use modern technologies like artificial intelligence, in order to commercialize collected data about us. They are able to connect your interests and preferences with identities. Once they have our social profiles it is easy for them to display an ad that will be probably interesting for us. Once we click on the ad the company earns money. Let’s have a look at the annual revenues of 10 global publicly traded internet companies from 2017 to 2019. The revenues are in billions of U.S. dollars.

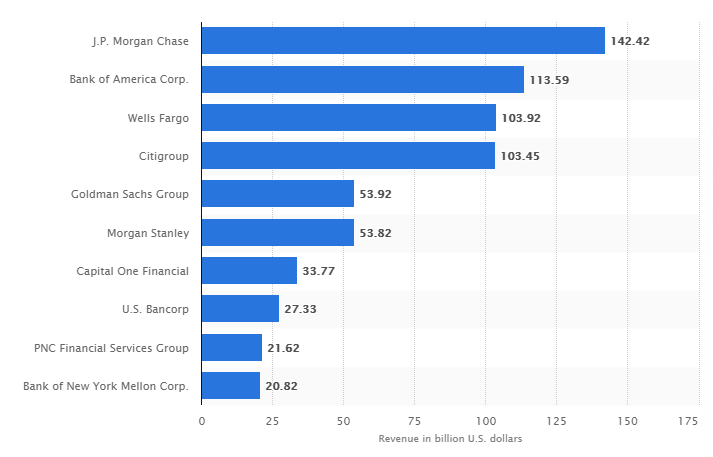

Let’s have a look at the annual revenues of leading commercial banks in the United States in 2019. The revenues are in billions of U.S. dollars.

All internet companies and banks listed above are centralized. Centralized subjects have owners that pursue making profits. As you can see the profits are really awesome. The question is for what we pay to them and whether they deserve to have such nice revenue. Centralization always poses threats and inefficiencies. Let’s have a look at a few of them.

- Centralized services are single points of failure from many perspectives. Data is stored in private databases and thus they might be misused either by owners or by hackers that succeed with breaking into the systems. Moreover, it is not transparent which data about us is kept and how it is used or commercialized. So our personal data or even money might be misused or stolen.

- Centralized services might be inefficient when there are more of them that need to communicate with each other. It might be a bit scary that there is still a lot of manual work in the banking system and some money or stock transfers might take a few days. We can see an unpleasant amount of error that could be avoided if subsystems would be better interconnected or there would be a single network.

- Centralization often means that there are a lot of rules that have to be followed. It might be internal rules of service or regulations required by states. As a result, services are prone to some form of censorship and many of them are exclusive. People cannot express their opinions or cannot consume services if they do not match a certain standard.

- Centralized subjects often have a monopoly and thus they can dictate excessive prices for provided services. It is not usually easy to establish a brand new bank in a country so there are often only a few of them and people have to choose one. People do not have the freedom in choosing a solution to which they want to trust. In the case of big IT companies, technological advancement is so significant that competitors might have tough times creating a competitive platform and attracting users.

- It is impossible to use centralized services privately since we do not know what happens with our data or assets. Owners can reveal data about us when a state institution requires that or someone is willing to pay for it. In the current financial system, it is not possible to make a private payment via the internet.

- There are still a lot of middlemen that take a lot of money for little work. For example, they just buy something from poor farmers cheaply and sell it for a much higher price. This unhealthy pattern is still present in our global economy.

- Sometimes, keeping money and other assets in a bank can be very risky. A bank can get into trouble and lose liquidity. We can lose our money just because bank management failed to do their job responsibly and transparently. A state can order to freeze accounts or limit the amount of money we can get out of an ATM per day. Keeping money on a bank account is generally very dangerous since we do not know what can happen with the account and we do not have it in our direct control. We have just login credentials to a bank’s web or PIN to the credit card but if it stops working that we have not a chance to get our money back. We can just wait for what is going to happen. This threat is more likely to happen when the whole world gets into economic or political trouble.

We are used to using centralized services and if you live in a western country you probably do not see any troubles or you do not realize it. It is also true for people from poor countries. They do not often have access to banking services but they consume internet services. There are a lot of troubles with using centralized services and we are a source of revenue for banks and big IT companies. They definitely deserve revenues since they offer their services and we use them. The question remains whether the revenues are adequate to the provided services and threats related to the usage. Anyway, we are going to talk about alternatives that blockchain technology brings.

Users must transact via blockchain

Nowadays, our society and financial markets are based on transactions. To fully utilize the abilities of blockchain technology we need to take a part of these transactions from the hands of centralized services and allow people to transact via blockchain networks. To achieve that, the user experience must be very similar if not the same, and a blockchain project has to offer the same or better services. Cardano’s mission is to become a social and financial global computer. It is designed to be able to become a global backbone for these transactions. The team put a big effort to solve the scalability issue and come up with the second layer solution called Hydra. The first layer of the Cardano will be able to process a few hundred transactions per second via the Ouroboros PoS consensus protocol. Hydra is a complementary part of the scaling solution. Every pool can create a new Hydra’s head so adding more pools means that more heads can be added. By that, linear scaling can be achieved. Each Hydra head can process around 1000 transactions per second (TPS). So with expected 1000 pools on the main-net, Cardano could be theoretically able to scale up to 1 million TPS. With resolved scalability and by utilizing other features like smart contracts, stable coins, identity management, ability to issue tokens, utilizing zero-knowledge for privacy, and interconnect with Oracle services, Cardano will be able to take over transactions from the centralized world and enable people to utilize advantages of the decentralized world.

Notice that it is really only about useful transactions. Holding cryptocurrencies coins for speculative reasons does not bring any value to people and does not disrupt the current traditional services. The competition to attract users will be about the number of transactions that will be processed by the Cardano network. People can avoid centralized services and benefit from decentralization only if they start using blockchain technologies on a daily basis. It is definitely not about sending ADA coins. Volatile coins are not suitable for payments. Cardano will allow issuing fungible and non-fungible tokens and can expect some form of stable coin. The majority of transactions will be related to these tokens. Thus, the technology can be used in health care, industry, banking, exchanges, gaming, data, and identity security, and many other sectors. New technologies are like Lego. We need to build new lego parts and put them together to have new functionalities. It is also needed to integrate the Cardano network with current services to make them more decentralized or we have to build brand new services. Cardano is designed to become the backbone of a new economic order. Cardano is not only a network but is also a platform and people will use it via decentralized applications or via services available on web pages.

Decentralized services to replace centralized one

Centralized services will disappear only if the decentralized one will be technologically ready to replace them and people will understand the benefits. It will be a difficult task if you realize that the position of centralized entities is very strong. There are IT giants, banks, regulators, and states. Politicians will protect banks and it is naive to think that blockchain technology can easily take over the financial sector. There will be pressure and a big push back from banks, regulators, and politicians. They will want to protect their positions and keep the status quo. All three entities behind Cardano work on adoption and communicate with all people that have strong say. It is needed to explain the technology to people in all positions including politicians and bankers. It might speed up the adoption.

Blockchain technology has many advantages that can resolve the threats listed above. Due to the absence of middlemen processes might be faster, streamlined, secure, private, and cheaper. The network takes over the role of the middlemen. Instead of the centralized entities that can make decisions about transactions and processes, the network will do it in a way that participants will have the power to dictate rules and decide what they want and how. Nobody will have a chance to censor it, sniff it, or even prevent it. It is impossible to stop a decentralized network so the service will be always available 24/7. There is no single point of failure in the decentralized network. What is in the blockchain is true including the whole history. Participants will define what is to be transparent and what should be private. Participants will be able to set rules and define what is allowed and what is not. If they wish to have a leader they can choose one and use voting to make democratic decisions. Transparency is the impossibility to make something shady with the resources of people is another strong ability of the blockchain. Society would basically want to have this kind of power and transparency within politics. It would prevent corruption and the stealing of public wealth. Cardano could ensure that from the technological point of view. It is on us to require the deployment of blockchain technology or begin to create new communities.

People generally know what is good and what is bad. If there are some disputes democratic voting should resolve them. Now we repeatedly see there is happening a many not nice things in the banking and politics sectors. Somehow, people lost the power to fix it. Now, we have a chance to do it with new technology. Blockchain basically fixes trust at places that are not trustworthy any longer. From a certain angle, blockchain can be perceived as a kind of trust layer or trust wrapper. It can ensure that trust cannot be so easily misused. Data integrity and security, privacy, transparency, the ability to set new rules and enforce them without compromises via smart contracts, and allow communities to make collective decisions are the strongest features of the blockchain technology and Cardano will allow realizing all of them.

The potential market capitalization of the Cardano project

We have defined problems resulting from using centralized services and show you the potential of the Cardano. As you could see there are a lot of sectors that might be disrupted by blockchain technology in combination with other decentralized features and services. Cardano will succeed if it begins to cut the market share of the current hegemons. It is needed to take over a part of the hegemon’s revenues.

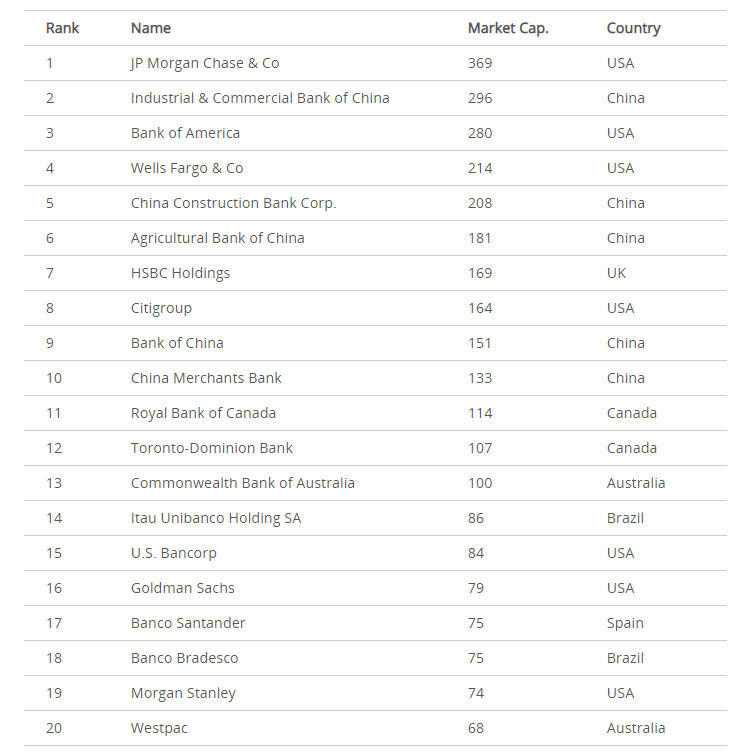

Let’s have a look at the market capitalization of the top 20 banks worldwide in 2019. Data are expressed in billions of USD.

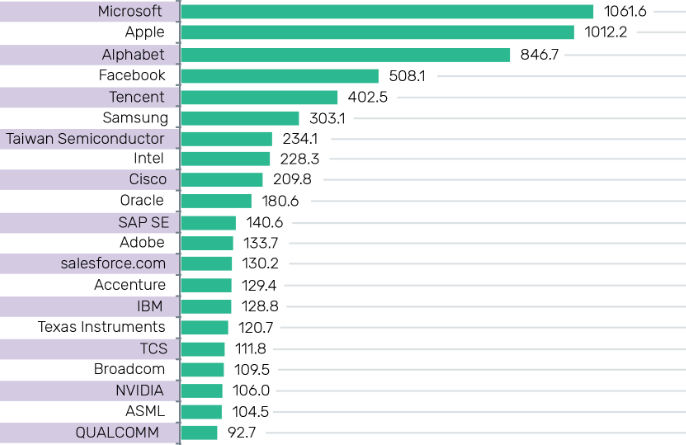

Let’s have a look at the market capitalization of the top 20 IT companies worldwide in 2019. Data are expressed in billions of USD.

Cardano can be considered an IT company since it is a platform. Blockchain technology will probably disrupt the financial sector. How to calculate the potential capitalization? We could consider the capitalization of all commercial banks in the world and have a look at what the capitalization of Cardano could be if it grabs only 1% of the capitalization of all banks. Let’s do it with only the top 20 banks. The total capitalization of the banks is $3,027,000,000,000. 1% of the number is 30,270,000,000.

We could do something similar with the revenues of banks. Let’s consider revenues only for the top 10 banks. It is $668,000,000,000. 1% of that amount is $6,680,000,000.

It is a bit more tricky with IT giants since some of them are more threatened by blockchain than others. For example, Apple creates smartphones and only the Apple pay service is only a minor part of the business. On the other hand, PayPal is mainly about transactions and the capitalization was $18,000,000,000 in 2019. 1% would be $180,000,000. Here, if you consider that blockchain might take over more than 1% quite soon. Moreover, Cardano will be able to transfer other assets. Not only money. It can be fair to consider 25%, which makes $4,500,000,000.

Yet another angle could be trying to find a place where Cardano could be in comparison with other IT giants. The market capitalization of Netflix was $20,000,000,000 and it is a streaming company. Cardano might have a much bigger impact on society so the capitalization could be let’s say 5x higher within 5–10 years. We think that $100,000,000,000 is quite a possible number.

Let’s talk about how taking over the market shares of banks and IT giants could be reflected in the ADA coin price. There is no central authority in the Cardano ecosystem that would take the profit. The network is owned by holders of ADA coins called stakeholders. As an owner of ADA coins, you can delegate coins to a pool. This process is called staking. Staking is a way to take part in the success of the network. The network must be profitable to be able to reward stakeholders. Transaction fees and fees for smart contract deployment are incomes of the network. The income of the network is distributed to stakeholders. Note that a part of the profit will be transferred into the project treasury. Thus, there will be enough resources for funding the development of the platform.

How many fees could be collected by the Cardano network? Well, it depends on the number of users that will switch from current solutions to the Cardano ecosystem. Let’s have a look at current leaders in the digital payment industry and the number of users. All these companies have approximately 3,300,000,000 users. It is expected that in 2020, 1 billion users will use smartphones for payments. 1% of that number makes 33,000,000 users that would send payment transactions via Cardano. If a transaction fee was $0,01 and users made approximately 1 transaction per day then the network would earn $330,000. It would be $120,000,000 per year. If you, as a stakeholder, had 0,1% of ADA coins you would earn roughly $100,000 a year. Notice, that we talk only about transactions fee related to the payment that can be realized via stable coins. Cardano will be able to transfer a lot of other assets. Moreover, there will be a network subsidy in the first years so the network will not be dependent only on the fees.

We intentionally do not want to speculate about Cardano’s market capitalization. We just wanted to present some facts. You can make your own opinion. There are many competitors in the crypto-space and we need to consider them. On the other hand, we expect that only a few of them will survive in the long term. The whole crypto-space can face regulatory scrutiny and political obstacles. It is needed to realize that by adopting crypto, banks and some companies can be less relevant. They will fight to survive and maybe try to use a private version of the blockchain. They will improve their services and they will innovate. All that must be overcome by Cardano and it will not be easy.

Having said that, we truly believe that Cardano could be a one trillion company. If it could happen then the price of a single ADA coin could be $22. It can take 5–10 years to get there. Maybe more. So be patient. The project is at the beginning. Firstly, Gogue functionality must be released. Then Hydra must be deployed. New features will be gradually developed and deployed. Developers must come, learn Plutus and Marlowe, and then they will be able to write useful decentralized applications. All that can take 1–2 years. The adoption of applications can be slow at the beginning and it could take another 1–3 years.

Summary

The world is more digitalized every year. It means that there are more transactions that have to be processed. Only platforms and services that process a significant amount of these transactions will be valuable. In other words, it is about the network effect. The more people a platform connects the more financial and social importance it will have.

Nobody can guarantee the potential future market capitalization of any project. It is even more complicated for emerging markets. Take as an optimistic estimation and take into account our bias.

Source: Let's talk about the realistic market capitalization of Cardano

Cardano is the first mission-critical blockchain project

Cardano is the first mission-critical blockchain project Cardano will be needed when crypto goes mainstream

Cardano will be needed when crypto goes mainstream Advanced safety considerations for secure Cardano and Web usage

Advanced safety considerations for secure Cardano and Web usage Cardano Smart Contracts

Cardano Smart Contracts