TLDR:

- PoS projects are on the rise. They get into the top 10 and pushed out PoW clones of Bitcoin.

- In terms of value transferred and the number of transactions, no project is dominant. Bitcoin, Ethereum, and Cardano are very similar.

- If the team abandons the project, people will gradually abandon it as well, because they will lose faith in it.

- 10 years ago, no one would have bet on governments adopting blockchain technology. Ethiopia adopted Cardano, El Salvador adopted Bitcoin, and Algorand.

- Using examples from El Salvador and Ethiopia, we can see that poor and developing people are more in need of financial and social infrastructure with cheap and fast transactions than volatile assets.

- The existence of strong influencers has no significant impact on the decentralization of the protocol. Significant people are important for adoption. Statistics show that people are interested in projects with strong leaders.

- People are encouraged to hold coins as an investment or store of value. However, they are also willing to use blockchain networks for other things within the DeFi and NFT sectors.

- The HODL narrative is all about dreaming about the far future. People live in the here and now. They want to actually use the networks for some activity.

- Transactions between people will have a greater impact on changing society than transactions between the exchange and coin holders. It is necessary to increase the network effect.

- It is naive to think that people will reject PoS for ideological reasons if it works safely. It would go against people’s natural desire to make things better and more efficient.

Narratives and reality

Bitcoin came with a vision of independent money. Monetary policy was fixed into the protocol and the network was to take care of the independent transmission of transactions between users. In the early days, bitcoins were actually used to pay for goods and services. People were willing to spend them. This gradually changed as the value of the coins grew. People started to speculate more and spend less. Now the narrative of the store of value is taking hold.

Ethereum is the second major project that still proudly holds the second position by market capitalization. With the advent of this project, it became apparent that Bitcoin would not remain the only big player. Bitcoin ceased to be money in the sense of an everyday means of payment and the narrative of a store of value became even stronger. In the case of Ethereum, the narrative of a world computer began to assert itself. These are two very different roles. Even so, communities began to dislike each other. Bitcoin proponents began to emphasize that Bitcoin can cover all the functionality we will ever need. The Ethereum proponent camp argued that this was impossible without smart contracts at the first layer and that it would go its own way.

Both narratives required different technological backgrounds. While the pressure to develop the Bitcoin protocol is low and the community can justify a slow and cautious development strategy, the Ethereum community announced early on an effort to move to Proof-of-Stake (PoS) consensus. For a global computer, scalability is an absolutely key feature. Both Bitcoin and Ethereum are using Proof-of-Work (PoW) consensus at the time of writing. PoW is characterized by the fact that at times of increased interest and network usage, transaction fees increase significantly and the clearance rate slows down. Both systems can quickly become clogged.

Higher scalability has more possible solutions. One is PoS and the other is fast second layers. The Ethereum team has not been able to deliver PoS on schedule and it will take some time. Cardano came on the scene and launched PoS from the Ouroboros family in 2020 as part of the Shelley development phase. This too has helped the project cement its position in the top 10 and is slowly becoming the third major project on the scene. It should be added that other concepts have emerged alongside PoS and many new projects are making their way into the top 10 at the expense of the old PoW clones.

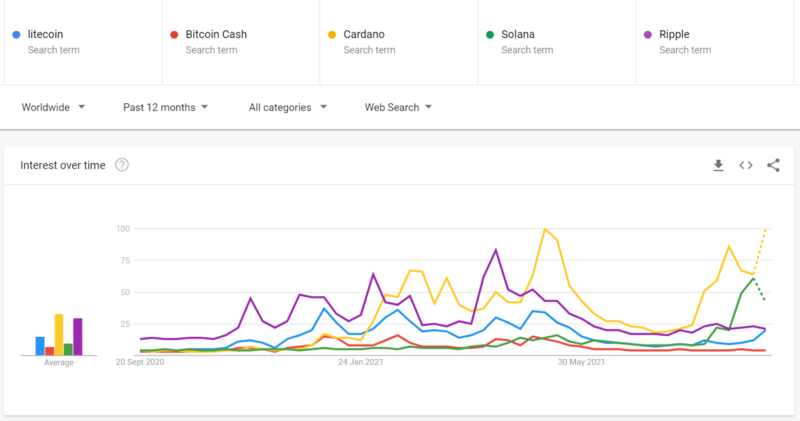

It turns out that there is no place for PoW projects in the top 10. The reason was the inability to innovate and differentiate from Bitcoin. It was only a matter of time before innovative projects pushed them to the background. People have become more interested in new projects and there is clearly a greater appetite to learn about them on Google Trends.

A strong community is very important for cryptocurrency adoption and information dissemination. People must not abandon the project, but stay loyal to it. People have abandoned PoW clones and stopped believing in them. No one is improving these projects and no one is trying to get them adopted. People routinely ask on the forums if the project has a team and if anyone is working on anything. The answers are often negative. If the team leaves the project, the community will eventually leave the project as well.

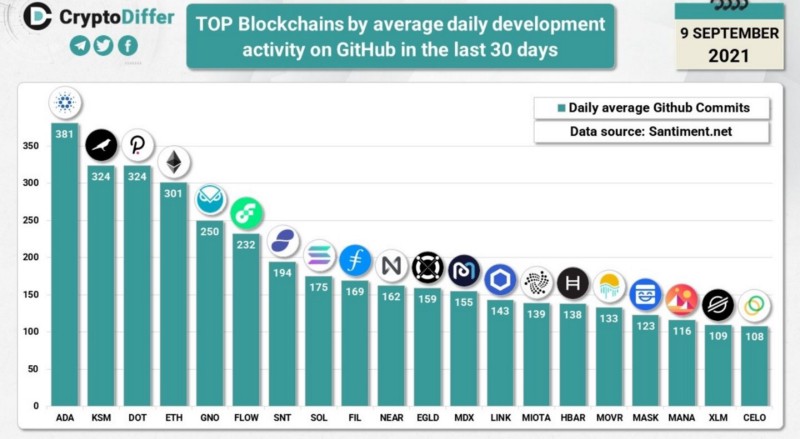

Cardano, on the other hand, has an incredibly strong and loyal community that believes in technological advancements and the humanly well-understood mission of the project. The IOG team has over 500 employees and continues to grow. The Cardano Foundation and Emurgo are also an integral part of the project and are also growing. All three entities are working independently to increase adoption and community growth. This work is paying off and seems essential to success. People see that the protocol is constantly being improved, which increases usage. Importantly, people are actually actively using Cardano. This is clearly visible in the activity on the network and the volumes transferred.

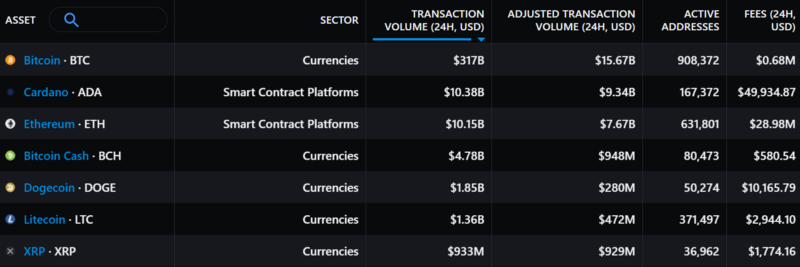

Messari collects on-chain data so we can explore it. As you can see, at the time of writing, Cardano carries more value than Ethereum and is second behind Bitcoin. The Bitcoin network has transferred $15B, Cardano $9B, and Ethereum $7B.

In terms of fees, Bitcoin collected 0.68M USD, Cardano 50K USD, and Ethereum a whopping 29M. Cardano has 600x cheaper fees than Ethereum and 15x cheaper than Bitcoin on the first layers. Let’s add that the fees on PoW networks fluctuate significantly more than on PoS.

Active addresses tell you the number of users who have used the network in the last 24 hours. First is Bitcoin with 900,000 addresses, second is Ethereum with 630,000 addresses and third is Cardano with 167,000 addresses.

It is clear that Bitcoin is not dominant compared to Ethereum and both networks are used similarly. When you consider the age of the projects, this is basically a success for Ethereum and it can be said that it is keeping up with Bitcoin. Cardano is the youngest project out of the trio and at the time of writing, smart contracts are literally a few days old. The high number may be related to the NFT boom on the Cardano platform. However, the same could also be said of Ethereum. Moreover, Ethereum has the biggest DeFi sector. It is always good to ask what the meaning of the transactions is. In the case of Bitcoin, a significant portion of the transactions will be related to moves to and from the exchange. In the case of smart contract platforms, it will be similar at this stage of the sector’s development, but we can assume that a greater proportion will be related to direct interaction between users. Platforms have stable coins and other tokens that incentivize the use of the network. This increases the direct network effect, which is beneficial for future development. Ethereum is only used about 4 times more than Cardano, which can also be considered a success considering the fact that Cardano has no DeFi services and no stable coin yet.

At the moment, it doesn’t look like Bitcoin is going to fundamentally outperform its competitors in terms of on-chain data associated with usage. Judging by the success of emerging projects, it is more likely that people are willing to use the networks and create interesting economic activity on them if it is fast and cheap. The second layer of Bitcoin such as the Lightning Network (LN) is not a competitor for smart contract platforms as it does not carry any tokens and has no programmability. The security of the tokens would have to be provided by the first layer and this is a non-achievable requirement in the case of Bitcoin.

If we examine market capitalization, we see a very similar picture. Bitcoin has approximately only twice the market capitalization of Ethereum. Cardano has approximately 10 times less market capitalization than Bitcoin and 5 times less market capitalization than Ethereum. These are not some fundamental differences. When you consider that institutions, banks, large companies, and now even the first state are investing heavily in Bitcoin, these are beautiful results for a smart contract platform. Moreover, Ethereum is in the crosshairs of big investors as well, Cardano is just at the beginning of its journey in this regard.

Reality shows that neither the people nor the big investors desire a single winner. People will try new technologies and use them if it benefits them. Investors will look for new opportunities and where else to look but in the emerging technology sector that has the potential to disrupt the world. PoW clones have never had a chance to be more successful than Bitcoin. People have sometimes laughed that Litecoin is just a test-net for Bitcoin. But in the case of smart contract platforms, the potential is tremendous. Cardano is a completely new technology. Nothing is copied. Everything is thought out to the last detail. The work has taken many years. The team is ready to deliver many more functionalities.

It’s easy to verify the team’s work by activity on GitHub. Cardano wins this statistic almost every month. People see technological progress and this is one of the many reasons why they trust the project. Big investors like to bet on new technologies in emerging markets. As in other areas of investing, early investment brings profit.

Can anyone today, at this point, estimate the future potential, the adoption rate, or the number of countries that will adopt Cardano? This is essentially impossible. 10 years ago, no one thought a state would adopt a cryptocurrency. Cardano was the first project to succeed. Ethiopia adopted this project to build its national infrastructure. People will have their identity on the blockchain. This is the first step for further financial opportunities. Bitcoin achieved similar success and became legal tender in El Salvador.

Adoption at the government level

El Salvador is arguably the biggest cryptocurrency success story since its inception. Many people have differing opinions on the government’s adoption of Bitcoin. Some celebrate it as proof that Bitcoin is establishing itself as global money. Others reject it because they don’t like that Bitcoin is adopted through laws and use is enforced by the government, which contradicts the narrative of non-state money. The adoption of bitcoin does not happen spontaneously by the population, which often does not even know what bitcoin is. Many imagine it as a metal similar to gold. Adoption is thus in the hands of the state, which is a double-edged sword. In the larger context, however, it doesn’t matter. Cryptocurrencies have drawn a lot of attention to themselves because of this event. What will come of it next remains to be seen. Let’s explore the solution from the technological point of view.

What is most interesting about El Salvador is that the biggest use of Bitcoin technology will be remittances. People living outside of El Salvador send money home to their parents through the expensive services of traditional financial giants like Western Union. Last year alone, remittance payments made up 23% of the country’s GDP, or about $5.9 billion. That’s an astronomical number, and it’s convenient to take advantage of the cheaper services that Bitcoin offers. The state gives people its Chivo wallet, which offers zero fees. Chivo will allow free conversion between BTC and USD. People will not be exposed to bitcoin volatility. The Lightning Network will be used for cross-border transactions. Strike company is involved in the solution, which will allow dollar value to be transferred via the Lightning Network.

Let us now ask the key question. What is more useful to the people of El Salvador? Is it the technology, i.e. the ability to send cross-border payments cheaply, or the volatile asset with its uncertain appreciation potential? Can the two be separated? From our perspective, it is economically dangerous for the poor people of El Salvador to invest in cryptocurrencies. Especially at the end of a bull run. However, when it comes to cheap dollar-denominated cross-border transactions, it’s a whole different story. It is economically viable for people to use such technology.

Do cross-border transactions need the first layer of Bitcoin? From the perspective of the people of El Salvador, no. They will have a wallet where everything will be completely free. At least initially, what will happen is that people will see the Bitcoin logo in the Chivo wallet, but in practice, they won’t own it or use it directly for transactions due to the rather centralized nature of the solution. It makes sense economically. The people of El Salvador cannot pay dollar fees for transactions, or even ten dollars or more during times of network congestion. The volatility of transaction fees is a killer for normal usage. When you look at the solution, you find that people need to work with stable value and cheap transactions. This is the exact opposite of the first layer of Bitcoin, which offers volatility in both coin value and fees.

It is, therefore, necessary to focus on the second layer and the Chivo wallet, which will be used by the people of El Salvador. Now let us ask ourselves some further questions. Who is subsidizing the transaction fees? Where does the current dollar exchange rate against bitcoin come from? If someone sends $1,000 from abroad to their parents in El Salvador using bitcoins as transfer tokens, what happens if the value of bitcoin falls? Will the parents still have $1000 in their Chivo wallet or less? What exactly happens when people exchange BTC for USD or vice versa in a Chivo wallet? People can see how many bitcoins and/or dollars they have in their Chivo wallets, but who physically holds the BTC and USD? Unfortunately, the solution is not very transparent and much of the information is shrouded in mystery.

Trying to make people’s lives easier through technological solutions is a noble cause, but let’s not forget the main goal of blockchain technology. The main goal of decentralization is independence from intermediaries who can abuse their position. From our perspective, this is far from being the case in El Salvador. However, that’s okay. It’s a good start and everything can improve in the future. It’s a bit paradoxical that people will use Bitcoin technology, but may not even want to hold or use the coins themselves. At least at first, people will still mainly use dollars. Volatility is a problem. In practice, it turns out that even Bitcoin may need a decentralized technological solution. In this context, it makes sense to build algorithmic stable coins, and it’s proof that DeFi is a very good direction for cryptocurrency development.

Besides Bitcoin, El Salvador has also adopted the Algorand project to build a state infrastructure on top of it. This is good news. It is clear that Bitcoin is not suitable for building financial or state infrastructure, and the other projects also have great potential. It is possible that El Salvador or another country will issue its own currency on some other blockchain that allows tokens to be issued and scales better than Bitcoin. This would be a very positive trend and we will very likely see it in the next 10 years, in part because of the CBDC boom.

Cardano can pride itself on being the first project in government adoption. Ethiopia chose Cardano to build a decentralized solution for managing the decentralized digital identity (DID) of citizens and improve the sector of education. If the pilot succeeds then other services might be deployed. Cardano and Atala PRISM will be used to build a national education tracking system. DID will be created for all participants of the education system which is 5 million students and 750 thousand teachers. The solution will be able to track attainment and digitally verify grades. It will enable authorities to create tamper-proof records of educational performance across 3,500 schools. Tracking will help to analyze under-achievement in education and allocate resources more effectively. Effectivity of the resource distribution will be ensured by the education tracking system. As it will not be possible to manipulate data thus the distribution of resources will be based on the real results.

Digital decentralized identity is also a very significant step forward. Not only monetary and fiscal policy but also identity management is one of the key tasks for states. For many financial transactions or interactions with authorities, identity is important. Identity is as important to people as money, or even more so. It makes sense not to limit the use of blockchain to money, but to use it for identity management as well. Let’s be realistic. States will never disappear from the world, and if cryptocurrencies are to survive, they will be regulated as states require. The crypto industry can resist this or keep up with the requirements of regulators. Many financial services such as loans and insurance need to work with identity. Many DeFi services can provide a better user experience if there is a way to work with digital identity. It is possible to have a state identity, but in principle, anyone can create another identity independent of the state. Even people who don’t have one today.

Who would have thought 10 years ago that blockchain technology would be adopted on a national level? Probably no one would have bet on it. Today, we are seeing the first successes. In another 10 years, it will be normal and no one will be surprised anymore. It is already clear that adoption will not be about a single project and that the key feature is mainly a technology that can solve a real problem for people. If this trend continues, blockchain has a bright future.

Decentralization and teams

One of the big misconceptions we see in the cryptocurrency space is the idea that a decentralized network must have no leader. The idea is that the leader centralizes the project. That’s a narrative fallacy. We need to understand that every project has a leader or a group of exposed people who are the spokespeople for the project. If a project doesn’t have anyone like that, most of the time people stop being interested in it. People have been living in a hierarchical arrangement for a long time. The advent of decentralized technology doesn’t mean that anything will change about people’s behavior.

People will make their own decisions, but before that, they will always look around to see what others are doing. Often what prominent figures say is important as they can influence the opinions of others. In terms of decentralization, it is important for a community to have multiple prominent figures and many diverse voices. However, the existence of someone who will be dominant cannot be prevented in principle. It is up to people to decide who they will listen to.

Let’s take an example. The biggest spokespeople for Bitcoin today are people like Michael Saylor, Adam Back, or Andreas Antonopoulos. These people have no influence on the decentralization of Bitcoin. They can’t influence monetary policy, for example. They are the people that other people like to watch and listen to. Satoshi Nakamoto left Bitcoin and quite naturally his successors were found. What is the difference between these people and Vitalik Buterin, who is the most famous figure behind Ethereum? Or Charles Hoskinson, who is the CEO of the IOG team? Neither Vitalik nor Charles can influence, for example, the monetary policy of Ethereum and Cardano. The network is decentralized and thousands of node operators, including all users, decide what change they accept and what they don’t.

Charlie Lee left Litecoin and the project suddenly lost its breath. Nobody talks about it and thus newcomers are not interested in it. The same can be said of the EOS project, which Dan Larimer left. No successor has been found, so people’s interest has waned there as well. If people are not interested in the project, there is no point in maintaining the source code. There is no point to build something on these projects. None of the current projects are ready for mass adoption. It’s not even Bitcoin, as is often said. Even Bitcoin will face major technological or economic challenges, and someone will have to be found to chart the future course.

The truth is that every project must have a strong team looking after the project. A prominent spokesperson for a project can be someone who is close to the team, like Vitalik or Charles, or someone who does not have strong ties to the team. Using the Cardano project as an example, it can be seen that people want to be well informed about the progress of the project, any problems, and plans for the future. This makes the project more transparent. There are communication channels through which people can express their wishes or doubts.

Another narrative fallacy is that without leaders, the project would cease to exist. Will Bitcoin disappear from the world if Michael Saylor decides to sell all the bitcoins and do something else? Absolutely not. Why would that be the case with Ethereum, Cardano, or any other project? If the leader leaves, the technology will remain exactly the same. The loss will be at the social level, not the technological level. In time, new leaders will emerge. Just as in the case of Bitcoin. The only difference is that Satoshi left at the beginning and handed the project over to the team. Microsoft survived without Bill Gates, Apple survived without Steve Jobs, and we could find many similar examples. Once Elon Musk leaves Tesla, you’ll still get a new model from the brand if you like it today. Technology survives its creators and is independent of them. The team and the users are much more important.

Leaders or team representatives are even important if the adoption of blockchain technology is to move forward. Companies, but also governments, need someone to talk to. El Salvador would never have adopted Bitcoin unless someone talked to the president and his people about it. If someone adopts something, they may have a lot of questions or even requirements for some functionality. It’s always better to have someone competent on it than someone off the street who may not have accurate information. Companies need to make sure that when they tokenize shares on Cardano that the project will be there in 20 years and that the team plans to maintain the protocol. If a company or government needs to ask questions, they have someone to contact. Who should answer similar questions in the case of Bitcoin? Who should listen to requests to address fee volatility?

Bitcoin adoption will be different from the adoption of second and third-generation projects. Representatives of the projects will travel around the world and offer their solutions to businesses and governments. This will speed up adoption significantly and the team can deliver the required functionality. History has shown that waiting for spontaneous adoption does not pay off and that communication is very important. Perhaps in the case of Bitcoin, spontaneous adoption is more realistic. Coins are being bought, by people, institutions, and banks, and maybe that’s enough. Cardano targets building financial and social infrastructure in developing countries and that’s a whole different use-case. Communication and explaining the mission of the project are important.

Cardano has a very strong community because people understand the mission of the project, have confidence in the strong team, trust the technology being built, and appreciate the high transparency of the project. It’s okay if someone disagrees with this approach. No one has the right recipe for the best way to do it.

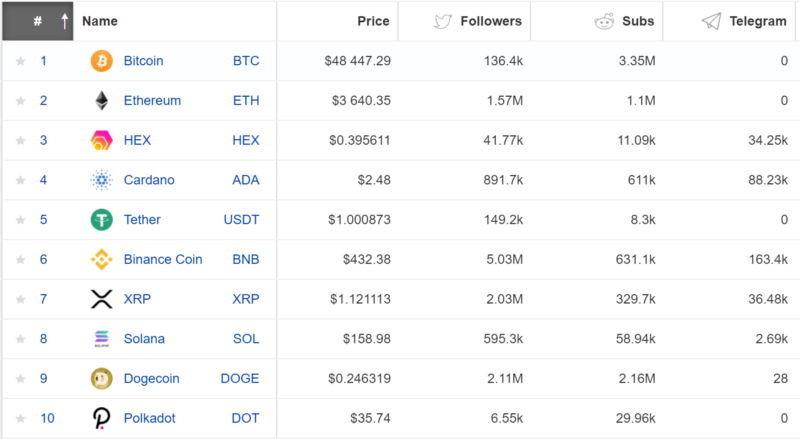

If we look at the statistics, we find that if a project has a leader, most people don’t see that as a barrier to becoming more interested in the project. More than 3.3 million people read about Bitcoin on Reddit, 1.1 million people read about Ethereum, and 610,000 people read about Cardano. The results will be largely influenced by the age of the project. Dogecoin’s result is notable with 2.1 million people. Here the result may have been influenced by Elon Musk, who drew people to the project.

If we look at major influencers, Michael Saylor has 1.5 million followers on Twitter. Andreas Antonopoulos 624 thousand, Vitalik Buterin 2.4 million, and Charles Hoskinson 688 thousand. Andreas Antonopoulos was the biggest spokesperson and advocate for Bitcoin at the time. Today, more people are interested in what Charles has to say than Andreas. Vitalik Buterin leads in this comparison, surpassing even Michael Saylor. From our perspective, people adopt blockchain technology because someone explains the meaning and purpose to them. It is also because someone will take care of the adoption, and this can happen at the level of large companies and countries. People have to take care of both.

HODL vs. real usage

Several people believe and argue that HODL will be the only useful application of blockchain technology. They were wrong. The DeFi and NFT sectors clearly demonstrate that people are willing to look for other uses. Stable coins have been created in DeFi and these are significantly helping real-world uses in the finance sector. Although the sector is still in its infancy, stable value is what can compete with mainstream banking services. Once the blockchain is able to work with real people’s identities, and Cardano has the ATALA Prism project to do this, everything will accelerate significantly. There are a lot of projects being created in DeFi that will die very quickly. Farming in particular makes little sense. These projects come into existence because smart contract platforms make them possible, and people are willing to jump on many nonsensical ideas with no real economic basis. However, this is only a passing phenomenon and does not prevent the emergence of serious services that can have a global impact.

The NFT sector is very young but certainly very interesting. The market is at risk of being overwhelmed with tokens, so supply will be significantly higher than demand. However, this does not mean that the works of major authors will lose value. Many artists appreciate the chance to get into the global market. However, over time they may find it difficult to make it in the global market. If major artists and businesses enter the sector, new art consumers will also come. The market will eventually rid itself of low-quality art and NFTs will be here forever in some form.

Interestingly, in the case of Bitcoin, the community does not care about regulation and interference from governments. On the other hand, for some sectors like finance, but also NFT, regulations could help significantly. Law enforcement is an important thing and blockchain cannot fully provide it. For example, copyright protection is almost impossible in the digital world. Regulations can bring a loss of privacy, so Bitcoin users will feel harmed. Art creators and their consumers will be helped by regulations, as they will feel protection for their intellectual or artistic assets.

From my point of view, the whole HODL narrative is all about dreaming about the far future. That’s perfectly fine from an investor’s point of view. But people live in the here and now. They want to actually use the networks for some activity. They want as good a user experience as possible while experimenting. Paying dollar fees and waiting a few dozen minutes for a transaction to settle is like using Windows 95 in 1995. It’s a good start, but for mass adoption, we need something else. Cardano chose PoS consensus for the reason that it will greatly improve the use of the system. People can already reliably transfer millions of dollars around the world in seconds for negligible fees. Hundreds of thousands to millions of dollars are transferred in each Cardano block.

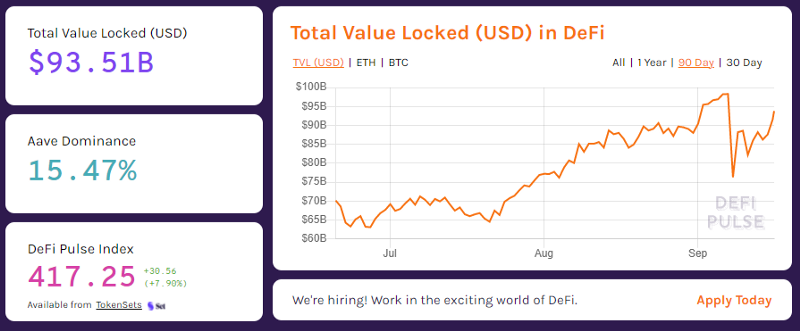

Ethereum wants to switch to PoS from PoW, as the demand for transactions is huge. There is almost $100 billion locked up in the DeFi sector. One can assume it would be much more if the Ethereum network had PoS today.

From our perspective, experiments in the ICO, DeFi, and NFT sectors, as well as adoption by governments, are more important than waiting to see what happens in 10 or 20 years. Coin holders are certainly an important part of the cryptocurrency space as the value of coins secures networks. However, the use of networks is more important as it is only through transactions that the network effect is created. People can hold coins on exchanges or their HW wallets, but it doesn’t force them to send transactions to anyone other than the exchange. Transactions between people, i.e. P2P transactions, are what will play an increasing role in terms of the importance of networks and their impact on changing our society.

What PoS brings to the table

We have already mentioned PoS in the context of better scalability and cheaper fees. Another important aspect is environmental friendliness. Not all people on the planet agree with using PoW and have a problem with it. We know many people who like the basic idea of cryptocurrencies but are downright bothered by PoW because they are environmentally minded. Elon Musk brought up the subject via Twitter and big investors have started to take an interest in the unfriendly mining. Institutions are starting to follow the ESG (Environmental, Social, and Governance) trend and have to justify the investment. This is not easy to knock off the table and it basically doesn’t matter how green PoW mining is. Energy consumption will always be enormous and the PoS consensus does not have this problem.

Many people will find the PoS alternative attractive and if PoS works well for the next 5 to 10 years, it will be viewed very positively in terms of technological progress. PoW may start to seem unnecessary as there will be a demonstrably workable alternative. This progress in people’s perception may be resisted ideologically by the Bitcoin community, but technologically it will be harder to defend. At this point, it is impossible to know what this may mean for the value of individual PoW and PoS projects. In any case, it would be naive to think that people will reject PoS for ideological reasons if it works securely. It would go against people’s natural desire to make things better and more efficient. In a world where decentralization may start to look like the solution to today’s problems, low energy consumption and greater efficiency is a major competitive advantage.

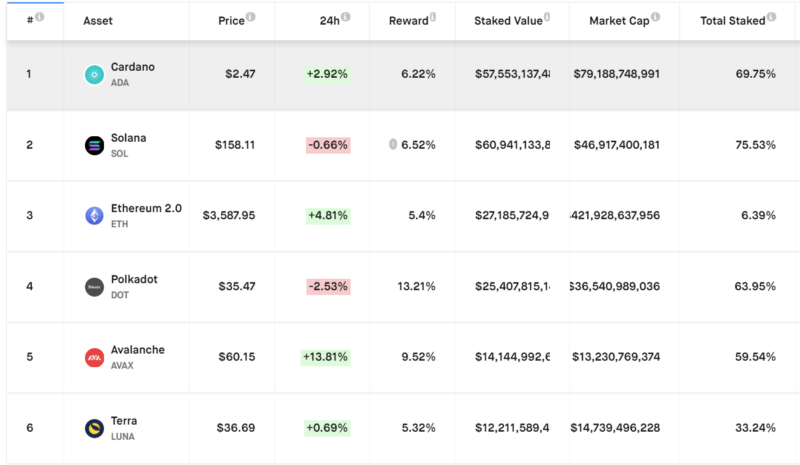

PoS brings another interesting economic angle. PoS allows rewarding all coin holders. This adds another dimension to coin holding, as holding is not a purely passive matter. Holding ADA coins in the Cardano ecosystem can generate profit. This is very attractive in a world where interest rates are constantly falling and inflation is rising. This is interesting for retail, but also for large investors. It is only a matter of time before they like the concept. Once they get their first reward, they may literally fall in love with PoS projects. PoS does not give out free money. Part of the rewards come from monetary expansion, similar to Bitcoin. The other part is just a redistribution of the collected fees. Cardano has a fixed number of coins, capped at 45 billion. Ethereum has even introduced burning some of the fees, so in theory, ETH could become a deflationary asset. PoS is able to redistribute the funds collected based on the success of the project to stakeholders. This is difficult to achieve within a PoW network.

Conclusion

Cardano is doing very well going with all the major trends. It allows NFT minting and has smart contracts, so we can expect a significant entry into DeFi soon. Cardano has something extra too. State-level adoption and potentially more in the pipeline. State-level adoption could play a significant role as people start using the network in the millions in a short period of time. Another ace up their sleeve is ATALA Prism, a decentralized digital identity solution. Hydra, Cardano’s second layer, will also bring many improvements over existing solutions. It can be said that Cardano is not riding on the success of Bitcoin and Ethereum, but is coming up with its own solutions, concepts, and innovations.

Cardano is not a mere clone like some projects from the crypto world. Cardano actually innovates and the team delivered PoS before the Ethereum team. Smart contracts will also be completely different on Cardano than on Ethereum. When designing technology like smart contract infrastructure, the team has to balance between multiple options and go in a certain direction. The resulting product will necessarily have different characteristics in terms of, for example, security, ease of development, verifiability, scalability, etc. Smart contracts on Cardano may thus be better suited for specific things, but less suitable for others. In technology, therefore, there will never be a winner in all categories. There will always be a winner in one particular category.

Cardano is technologically ready for adoption and people are not hesitating to use it. In the PoS sector, Cardano boasts the largest ecosystem. Companies and countries are interested in blockchain not because of speculation on price, but also because of real-world use. Cheap and fast cross-border transactions solve a real problem. If there are more solutions on the market, it will only be good for people. Competition is healthy and prevents abuse of power in the case one project would win everything. In El Salvador, the solution is not fully decentralized. People are economically motivated to use the best available solution on the market. People in El Salvador get a Chivo wallet from the government, but they can basically install any other cryptocurrency wallet and use another network for the same purpose.

Cryptocurrencies follow the Bitcoin halving cycle. We hope one day this will change. Thus, the longevity of projects can be judged not by the number of years they have been around, but by the number of bull markets they outperform and stay in the top 10. 2021 is the second bull market for Cardano, and there is no reason to think it won’t stay in the top 10 until the next one. With a huge team behind it, a strong community, and the technology it brings, it will be here for decades to come.

Source: The evolution of cryptocurrencies and how Cardano fits in

Is Cardano the biggest innovation after the Internet?

Is Cardano the biggest innovation after the Internet? Cardano OBFT Hard fork explained

Cardano OBFT Hard fork explained Cardano and Bitcoin can coexist and support each other

Cardano and Bitcoin can coexist and support each other Cardano has the second mover advantage

Cardano has the second mover advantage