How a centralized world works

The internet is at the heart of what we do and everything that happens on a digital level has an overlap into the physical world. If we want to exchange value with someone remotely, we have to take care of that in the physical world first. This means that both Alice and Bob need to open an account with their bank. In practice, they visit the office, submit the necessary information about themselves, and the clerk sets up the account. If Alice wants to send money to Bob, she must ask him for his account number. Bob will then see the transaction from Alice in his online banking and will know her bank account. It is important to note that the bank plays the role of an intermediary in the transaction. What does it actually mean to be a centralized intermediary in a traditional world?

It has two levels: digital and social. On the digital level, it means that there is a server between Alice and Bob that is managed by an administrator. Often it’s multiple servers, for example, if Alice and Bob each have a different bank or are based in a different country. At the network connection level, this means that Alice has to connect to the bank’s server via her bank client to send a transaction request. Alice doesn’t hold the money in her wallet or in her hand. The money exists in a digital form on the server, and Alice is merely making a request to send a portion of the money to Bob’s bank account. The money in the bank is essentially just a number in a centralized database. Alice’s bank sends the money to Bob’s bank server. If Bob wants to make sure the money has arrived, he must connect to his bank’s server through his bank client. The process of sending a bank transaction uses a client-server architecture. In order for Alice to connect to the server, she must know the necessary credentials for the connection, which are provided by the bank.

We have described the process from a technical point of view. However, the social dimension of the operation is more important. In order for Alice to send the transaction, the bank server must be running and everything must be set up well. The bank administrators take care of that. Above the administrators, however, there is a whole hierarchy of officials, rules, and laws that must be respected. The bank can decide to whom to open an account and under what conditions. The bank is pursuing its commercial best interests, which can itself be discriminatory. Furthermore, the bank must respect the laws of the country and obey a request to hand over transaction information or freeze the account if the authority wishes. Transactions are monitored and suspicious ones reported to the authorities. A transaction is only executed if it complies with all rules and conditions. An individual, through his power or position, can prevent a transaction from being executed.

However, centralization also has its bright side. The legal system is essential when Alice sends Bob money but Bob refuses to honor his obligations to Alice. At the same time, he doesn’t want to pay her back. Alice can find support in the legal system and get her money back. Bob cannot abuse the digital system to his advantage. The bank knows Bob’s identity and is obliged to provide this information to the legal system.

Without the legal system, even regular internet payments would not work on a blockchain. Once you have paid for goods that the shop subsequently fails to send you, you have little choice but to use the legal system and ask for help to resolve the conflict. Money works because of the state and all the institutions that guarantee that no one will cheat. Fraudsters need to be punished, as this is the only thing that maintains society’s confidence that they can reliably buy goods online. You could certainly think of many other examples where the supervision of the authorities is important. Technological innovations can help us make the use of decentralized money more reliable, but 100% decentralization is probably not possible.

The digital and social aspects of centralized services have been relatively well aligned over their long history. The system has its bad and good points and the quality can vary significantly from country to country. In some places, transactions are free and very fast even at the weekend. Elsewhere, the financial infrastructure is completely absent or of very poor quality. The question is what quality a decentralized system can provide and what all can change.

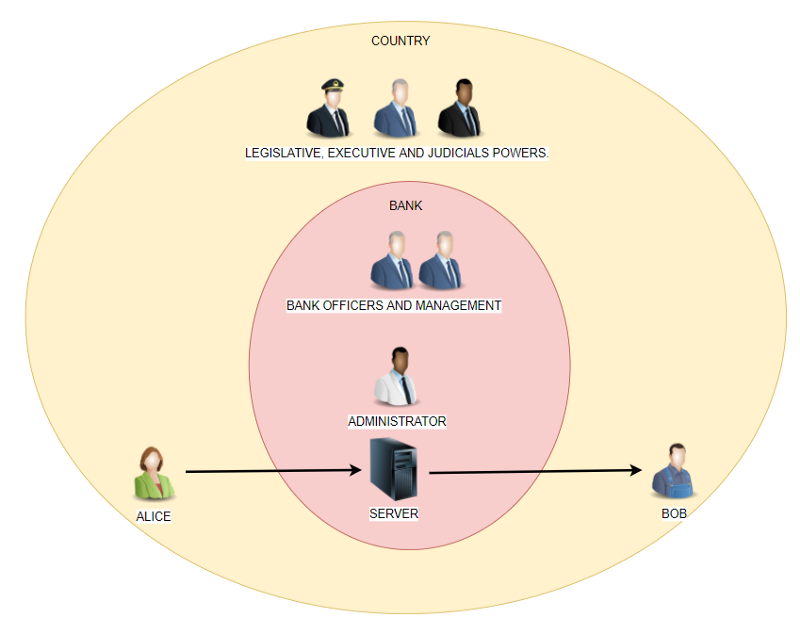

In Figure 1 you can see a diagram of how a bank operates in a centralized world. Suppose Alice and Bob have a bank account with the same bank. The execution of the transaction is fully in the power of the bank and its staff. The bank operates in a state, so it is subject to local legislative, executive, and judicial powers. As noted above, this balance of power has advantages and disadvantages. If Bob is a terrorist, it is disadvantageous for him to use centralized services. He probably won’t even set up a bank account and only works with cash. If Alice is trusting and pays Bob upfront for work, this system is very favorable to her. The legal system can force Bob to fulfill his obligations to Alice or pay her back. Note that Alice does not ask the bank, i.e., the transaction intermediary, to solve the problem when Bob defaults. Alice must turn to the legal system, which can ask the bank to cooperate.

How to make a transaction on the Cardano network

The whole beauty of decentralization is that decision-making power is not held by individuals, but by a larger group of people who are independent of each other. These people are economically, but also socially, motivated to behave fairly in the Cardano network ecosystem. Thus, the network does not have a single center of power, either at the network level or at the social level.

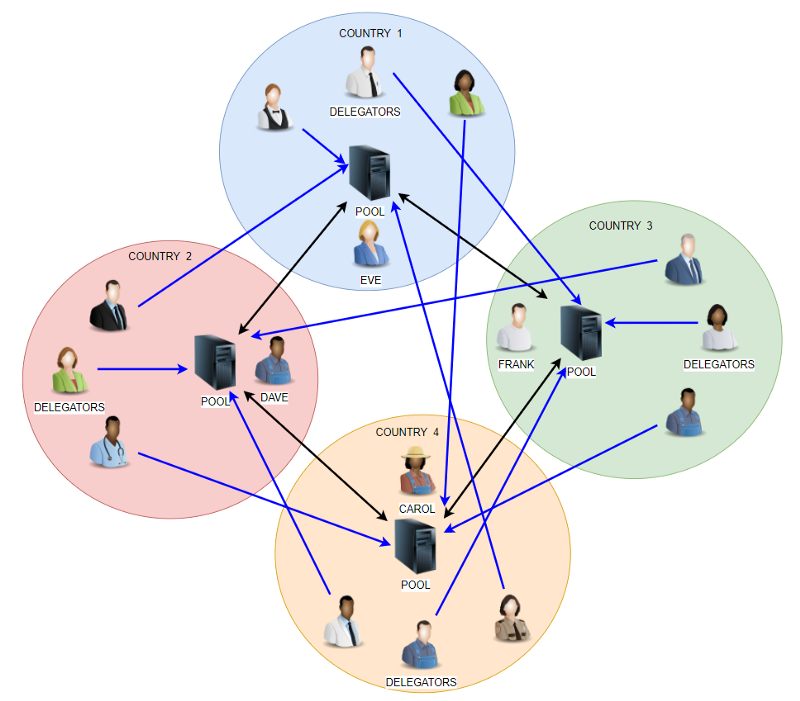

At given time intervals, the Cardano network produces blocks that contain all the transactions currently waiting to be processed. The transactions are propagated throughout the network to the nodes of the so-called pool operators. The pools are interconnected with each other, as shown by the black arrows in Figure 2. You can see that the Cardano pools are operated by Carol, Dave, Eve, and Frank. Each pool is located in a different country. It is not known in advance which pool will produce a new block. The pools take turns producing blocks for each other. If a transaction is valid, that is, conforming to the protocol rules, sooner or later it will get into the block and the value will be transferred.

It is everyone’s free choice to become a Cardano operator. There are no restrictions at the protocol level. Anyone with the necessary technical knowledge, equipment, and sufficient financial resources can start producing blocks and participate in the decentralization of the network. In the Cardano ecosystem, you can participate in decentralization even if you do not want to or cannot operate your own pool. If you buy ADA coins, you can delegate them to a pool you trust. The system is basically analogous to PoW mining. The difference is that PoS consensus is more inclusive than PoW, as you can only participate in decentralization through ADA coins. You don’t have to buy expensive mining equipment and pay for the electricity costs, as is the case with PoW networks. Coin delegation is shown by the blue arrows in Figure 2. As you can see, people from one country can delegate their coins to a pool that is physically located in another country. Don’t be fooled by the intricacy of the arrows in the picture. The advantage of decentralization is that it is relatively complex and difficult to decipher. The anonymity of the participants, pool operators, and delegators is a big advantage for decentralization.

Anyone can freely choose to buy ADA coins to support the strength of a pool. The stronger the pool, i.e. the more ADA coins behind it, the more often the pool produces blocks. If a pool is not behaving in the best interest of the ecosystem, people can delegate their coins to another better-performing pool. Each pool is thus backed by an independent operator, supervised by a given number of delegators. This could be as few as 10 delegators with a large number of coins, or a larger number with fewer coins. Ideally, the distribution of coins among people will grow, and so will the decentralization of the Cardano network. The number of pools will also grow. It would be nice if there were several independent pools in every country in the world. It should be noted that pool operators and their delegators do not know each other.

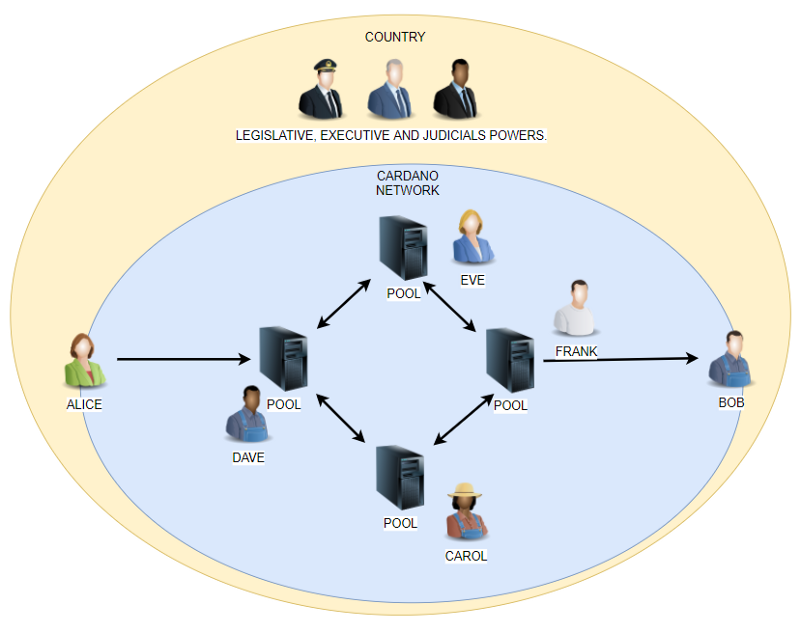

It is important to note that although the Cardano network is decentralized at the network level, the pool operators and all users continue to live in their respective states. Thus, the legislative, executive, and judicial powers still have a great impact on the functioning and influence. The application of laws and regulations is a big topic for cryptocurrencies and we will only touch on it in this article. People may live in states, but if they start using a decentralized network, they are somewhere on the border between a centralized and decentralized world. You could even say that people can to some extent choose what kind of world they want to live in. By using blockchain networks, people do not cease to be citizens of their countries and still have to obey laws and pay taxes. In Figure 3 you can see how a transaction takes place on the Cardano network. As you can see, Alice and Bob are half in the blue ellipse and half in the yellow one. This is because at the network level they are fully in the decentralized world, but in the physical world, they remain in the centralized one.

If Alice wants to send the ADA coins to Bob, as in the previous example with the bank, this is as follows. Alice’s transaction will first go to the pool operated by operator Dave. The transaction is gradually advertised to the other Cardano pools so that operators Carol, Eve, and Frank know about it. The pool that is first to produce a block is given the right to include the transaction. This can be any of the pools. This makes it very hard to censor a transaction or request that it should not take place. For example, if Dave was tasked to produce a block and for some reason did not include the transaction in the block, in the next round the pool Eve would be tasked with producing the block and so would include the transaction. Once the transaction gets into the block, Bob essentially owns the ADA coins and the transaction cannot be reversed.

The main difference between a blockchain and a bank is the fact that ADA coins, as well as all issued tokens on the Cardano network, are always owned by the users themselves. The network, in its role as a decentralized intermediary and the one who is responsible for the transfer of value, can operate the coins according to the rules of the protocol or according to the rules of smart contracts, but cannot do anything else. The network as such, through pool operators, cannot decide to somehow take your coins or freeze your account.

The legislature, executive, and judiciary in a given country have no chance of preventing the transaction, as it may get into the block in another country. Cardano is a public global blockchain network, so one country’s regulations do not affect the operation of the network in other countries. This makes it relatively difficult to regulate the cryptocurrency space. A given state can ban its citizens from using cryptocurrencies on its territory, but it cannot stop the network from functioning. If citizens decide to break the law and use the network, the network will process their transactions, as it does not care whose transactions it processes. Literally, anyone on the planet can start using the network. Just install a Cardano wallet. If you have access to the internet, you can start taking advantage of everything Cardano has to offer.

The legislative, executive, and judicial branches will continue to determine the rules of the game in the physical world. In the case of Cardano, however, its position is weaker, as no power in the world has the ability to alter the data on the blockchain. Anyone is free to analyze the blockchain, to associate blockchain addresses with real identities, but it is not possible to externally change the ownership that resides in those addresses. This does not mean that the executive has no powers. If Alice pays Bob upfront for work and Bob refuses to do the work and return the money, Alice can still appeal to the authorities of the country in question to resolve the conflict. Thus, the authority can force Bob to do the promised work, return the money through a blockchain transaction, or punish him. At the level of the transactional network, there is no way for the blockchain to ensure that participants in the physical world act fairly. If blockchain networks are to become massively widespread, we will always need authorities to help us resolve conflicts.

If Alice and Bob have some nefarious activities and want to exchange value remotely, blockchain is perfect for them. The blockchain transaction cannot be prevented, so if Alice and Bob can be sufficiently anonymous and don’t mind the transaction being on the blockchain forever, the blockchain offers them a solution.

What is the goal of decentralization?

The goal of any network is to be as decentralized as possible at the network level. Once this has been achieved, we can ask how the concept of decentralization can be promoted at the social level and what can be changed in the functioning of our society as a result. Decentralization is really not so much about how well decentralized Cardano is compared to the competition. Don’t get us wrong, Cardano is doing very well in blockchain decentralization and is definitely one of the most decentralized networks in the cryptocurrency space. But that’s not what this is about. The right question is what we have managed to decentralize so far on a social level and how far we can go.

Blockchain technology is an alternative to existing services. The teams aim to deliver technology that is better than traditional services. The goal of the community is to convince people that using decentralized services can bring us some benefits and change some things that we can’t change otherwise. The more people adopt Cardano and other public networks, the more regulatory pressure will grow. It is important to remember that the current political system is centralized. The problem can be seen as a middle ground between centralization and decentralization, where the power of centralization comes mainly from the physical world through traditional authorities, while the power of decentralization comes from the world of technology. Some of the benefits of decentralization may disappear if regulations are too harsh and consistently enforced. At the moment, centralization is still the stronger player on the battlefield, and most people on the planet are comfortable with that. Before we talk about what we have actually managed to decentralize so far, let’s explain what Cardano and other networks actually offer us.

In a broader context, a decentralized network is essentially just a set of rules that cannot be changed by an individual. The rules are accepted by the majority, and if they are to be changed, the majority of the community must agree. Note that from the perspective of the average user, it is the rules or certain features that are significant. Here you can observe a certain parallel with the traditional centralized system. Our society is governed by rules and laws that the majority of the population accepts and respects. However, there is a minority who may not like the rules and deliberately break them. In every society, there are measures to prevent the minority from disrupting the work and happy life of the majority. There are countries that are democratic and, unfortunately, there are also countries that are authoritarian. It can happen that the rules of the game are set by the minority at the expense of the majority. For the purposes of this text, it is important to know that there is always a select group of people in society who define and change the rules.

What rule is the most important of all in the blockchain world? Probably everyone would answer that there will only be 21M BTC coins. Similarly, probably most Cardano fans know that there will only be 45B ADA coins. We can say that we have managed to create a decentralized monetary policy, where a community of people watches over the rules regarding coin issuance and the maximum number of coins. Recall that in the traditional world, central banks are responsible for monetary policy. These banks thus essentially define the real purchasing power of money. States and their economies are behind fiat currencies. The majority of the population trusts their governments, and hence fiat currencies. Trust in governments may fluctuate or even steadily decline over time, but we do not yet have a better alternative.

Do we need a decentralized network in addition to the rules defining decentralized monetary policy? Yes, we do. ADA coins, as well as BTC coins, are rare assets whose strength lies mainly in the fact that we can not only own them directly without a centralized intermediary but also send transactions. The power of money, but also of all other assets, lies mainly in the fact that we can dispose of them and send them to each other. The blockchain network has to supervise the transfers of value, as it can keep track of the number of coins to be in circulation at any given time. For example, if ADA coins were held by a bank as it does with fiat currencies, transactions could be completely for free and settlement would happen in seconds. The transactions would be even more anonymous, as only the participants and the bank would know about them. Once we allowed this to happen, all the benefits of the blockchain would be lost. Again, the bank could freeze your account and confiscate your money. It could charge you large fees or misuse information about transactions. The bank could even inflate the maximum number of coins. That means it would hold fewer ADA coins than people would have in their accounts.

The biggest advantages of blockchain lie in the rules that apply to the transaction network. The transaction network is what allows you to send a transaction to someone else. Keeping coins in your wallet without the ability to send them to someone else would make no sense. The moment the coins were held by a bank that could send them to someone else, the trust would again be in the bank and not in the decentralized network. Features such as censorship resistance of transactions, availability of the network worldwide with the ability to start using the network without permission, the same rules for everyone, verifiability of transactions on the blockchain, and more, are the most important things about the blockchain.

Which is more important, monetary policy or the properties of the transaction network. The two are related, but one could argue that the properties of the transaction network and the records in the blockchain are useful beyond the native ADA coin of the Cardano network. Monetary policy is primarily important for the economic sustainability of the network. Through this, decentralization and security of the network can be ensured. The secondary importance of monetary policy is an investment. However, once the decentralization of the network is secured, the transactional benefits of the network and blockchain can be leveraged for other assets. For now, the best use is stable coins. There are many people on the planet who do not have a bank account. If they have access to the internet, they can install a Cardano wallet and in that morning they can send any assets including stable coins over the Cardano network. You could say that they essentially have a bank account that way, as they can send money to other people safely across their national borders. These people don’t have to care about the existence of ADA coins and the monetary policy of the project. They just need the network to be available and they can store their money in the blockchain. Now let’s go back to our original question. What have we actually decentralized so far? They are also transaction networks. So blockchain is competing to some extent with projects like PayPal and VISA. In terms of scalability, blockchain has so far lagged behind these traditional services. It’s certainly one of the reasons why cryptocurrency adoption has been relatively slow in terms of usage. Slow and expensive transactions on the blockchain essentially prevent direct use.

Is the goal of decentralization to replace Paypal and VISA services? Of course, it is, if our goal is to become responsible for our funds and data. Any third party holding our funds poses risks associated with centralization. Not only does trust return to centralized service, but it is also a security issue for public networks. The existence of networks depends to some extent on collected transaction fees. If people do not use the first layer of blockchain protocols, networks will no longer be secure. It can be said that if people care about monetary policy, they must use a decentralized network directly and nothing else.

Centralization is not necessarily a bad thing, as long as you follow the rules of society, you won’t lose your money. So, if you trust the state, you probably have no problem trusting banks and all the services that come with money. But there is another dimension to the matter. Blockchain technology has the potential to do more than just decentralize traditional transaction services and setting up a bank account. As we said, everything around us revolves around rules. Rules can be broken by someone with some power or courage. Whoever has the power usually has some information that others don’t. That can give you some advantages. A decentralized network is not necessarily just about transactions, but also about defining rules. Smart contracts can build decision logic over the transactional network. This can make the concept of decentralization disrupt other traditional services. Defining the rules and their subsequent use, where the decentralized network is responsible for the execution, is a game-changer.

Banking services will be disrupted first. Once stable coins become more established, Cardano will be a direct competitor to banks in terms of account opening and sending transactions. Setting up an account will be completely free, sending transactions for blockchain fees. Thanks to smart contracts, the lending, savings, and insurance sectors may soon be disrupted as well. It is important to note that these sectors cannot be disrupted with volatile ADA coins but only with stable coins or tokenized assets.

It is important to mention that the goal of decentralization is not necessarily to take jobs away from people working in the bank and have banks that operate completely without people. People will still be needed to assess risks, provide advice or assist with setting up smart contracts. You could say that through smart contracts, certain processes are automated, which puts the bank and customers on an equal footing. Bank officials will be paid for quality service, not for owning the technological infrastructure. The rules will be simpler and neither the bank nor the users will be able to change them. The bank will thus use the existing Cardano infrastructure, but will not own it.

The concept of decentralization certainly does not have to end with monetary policy and the transaction network. In general, the aim of decentralization is to create new power structures that take away much of the decision-making power from individuals. It is not necessarily about completely replacing the people who work in existing services with technology, but rather about streamlining processes, increasing transparency, putting more decision-making power in the hands of individuals, and so on. The world is too complex to make do with monetary policy rules. The world needs many more rules. Cardano will make it possible to define rules, for example, for the creation of coins, the conditional exchange of assets, the asset custody service, and so on. Cardano will even make it possible to work with people’s identities, and people can already vote in a decentralized way on what projects to fund. Catalyst is probably the biggest experiment in terms of decentralized voting on the blockchain. The people holding the ADA coins will one day vote on the rules and any changes to the protocol. This will make the team responsible for carrying out the will of the majority of users. People can even vote on which team will make the changes. So far it is working well and it will be possible to transfer this concept to traditional institutions.

Smart contracts can define rules for just two participants, but also for certain groups, no matter how large the group is. This is a very powerful concept. A group of people can define certain rules among themselves and use a decentralized infrastructure to take care of the execution. The legislative, executive, and judicial powers will still exist in a decentralized world, but only as a kind of protector of last resort.

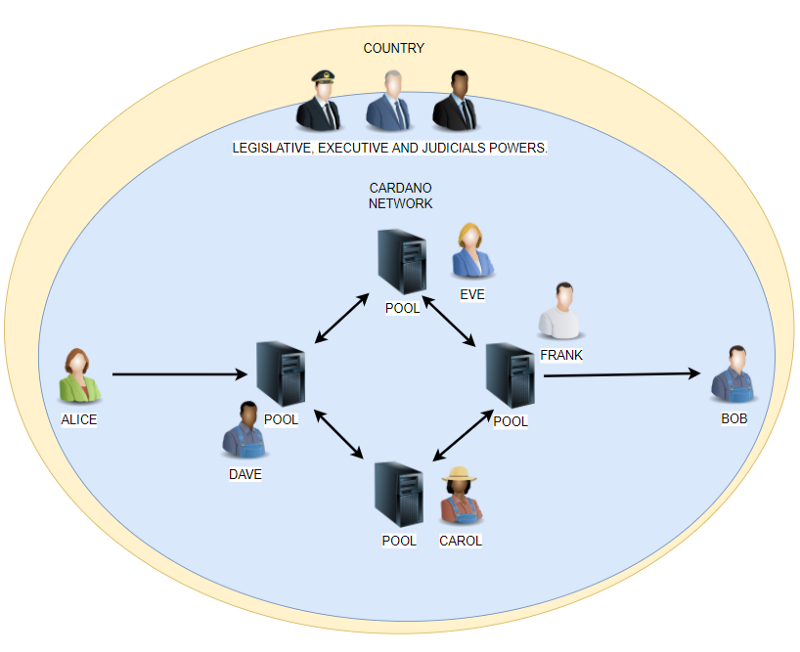

The world could work similarly to Figure 4. Alice and Bob are fully in the decentralized network, hence they are in the blue ellipse. They decide for themselves what services to use and vote on the rules of the society they live in. There will still be authorities who will do their jobs and retain the right to resolve conflicts. Criminal activity will be a phenomenon that our society will never get rid of. However, authorities will also use blockchain more and it is up to us to decide to what extent. In a free country, people should set the rules of the game, not politicians. If the majority is convinced of the benefits of using blockchain, it should not be a problem to push institutions to use blockchain in the right places.

From outside observation, you might not even notice that anything has changed. The change cannot come about abruptly. Rather, it will be gradual and will respect technological progress and possibilities. Moreover, it is possible that change will take place at a different pace in each country. As technology takes hold in one country, others will follow over time.

Let’s take one practical example for all. As a citizen of a country, you will always be obliged to pay taxes to the authorities. Decentralization will not change that. What it can change is the actual collection and use of the funds. An ordinary citizen does not know how much is actually collected in taxes and what happens to them next. Authorities can inform their citizens, but we are already losing trust here. In a democratic society, audits and other control bodies should work, but even here, citizens usually have to trust more than to verify things themselves. Paradoxically, banks know exactly how much is collected in taxes and often also what the authorities do with the money. What if citizens could monitor the financial flows of the authorities and thus verify that the taxes collected will not be embezzled or stolen? And what if citizens could vote locally on what the municipality would spend its money on? Purely theoretically, it would be possible that the authorities will not dispose of the funds directly. The funds could only be in custody and people would decide by voting to whom they should be sent and for what purpose. The money could be spent directly by the recipient, not by the authorities themselves.

In the Cardano network, transaction fees are placed in the treasury and some of them are used to finance Catalyst projects. People are voting on what funding projects they will receive. This is very close to what we have described with the collection of taxes and the subsequent distribution of funds. In fact, it is up to us citizens to see this decentralized principle in practice within the authorities. Officials would basically just suggest what could be funded. However, citizens can do it themselves. The role of the authorities could thus change fundamentally.

Freedom

Let’s take another look at all the pictures. As you can see, the biggest difference is between Figures 1 and 3. The red ellipse in Figure 1 represents the centralized bank. The yellow ellipse represents the centralized physical world including the authorities. Alice and Bob are completely at the mercy of centralized authority. The bank knows how much they both earn, what they buy, and who they send transactions to. The bank can dictate and change the terms of their bank account. If someone sends a large transaction, the bank can suspend it and ask about the origin of the money. It would be similar if Facebook was in the picture instead of the bank. Facebook accumulates a lot of data about you and without you realizing it, it basically influences your decisions and opinions. This can be seen as an unfreedom that stems from an unequal position.

In figure 3, the blue ellipse represents the decentralized world. Alice and Bob are partly in the decentralized world and partly in the centralized world. Figure 3 thus represents the current state of cryptocurrency adoption. People can use blockchain technology and there are already benefits. They can send value quickly and cheaply, which will especially benefit the unbanked. This also protects their privacy. Furthermore, they can speculate on the rise in the value of cryptocurrencies and defend against inflation. This benefits the individual, but not society as a whole. Citizens still have the same rights and obligations towards the authorities. If, for example, there is high corruption in a country, nothing will change in terms of living conditions.

In Figure 4, the authorities are also partly in the decentralized world. We will never get rid of centralization because we will always live in a physical world and our society has evolved over the years to the point where a hierarchical arrangement is the best for us. Extending decentralization higher up in the hierarchical structure makes sense. It does not make sense for citizens to use completely different and more modern technologies than state authorities. It would probably be the first time in human history that this has happened. At the same time, changing the technology can change the rules or laws for the better from the perspective of the users, see the example of tax collection above. In El Salvador, the constitution also changed after Bitcoin became legal tender. We expect that the adoption of blockchain will sooner or later have a positive impact on lawmaking. First will come regulations, which may not be entirely positive, but in time this may change for the better. A blockchain is just a tool and it is up to people how they use it. If it becomes quite common for Alice and Bob to borrow money in a decentralized way through smart contracts, the laws will somehow cover this possibility. If the banking sector can be disrupted and everyone in the world can afford a loan, especially those without a bank account now, the world will be freer.

At the moment, there is no indication that we can do without governments and their authorities. Or even though it may seem to some group of people that technology will allow us to do without authorities, it does not necessarily mean that this change is applicable on a mass scale on a social level. On the other hand, the gradual adoption of blockchain can bring us many benefits. We do not think that the aim of decentralization is to create new non-state money and through it to get rid of authority altogether. The goal of people pushing decentralized technologies is to convince other people, including authorities, that using blockchain can improve the functioning of society and put more rights back in the hands of individuals. That may not look so cool at first glance, but it’s actually exactly what we need. The right to privacy, equality between all citizens and between citizens and authorities, preventing corruption through greater transparency, cutting red tape, and increasing efficiency are all things that will help each and every one of us.

It is often said that non-state money can bring us more freedom. However, the lack of freedom is not because we have bad money. Inflationary money may harm us economically, but it certainly does not take away our freedom. Nor does freedom consist of choosing decentralized money and stopping paying taxes. That is commonly called tax avoidance and is a criminal offense in most countries. Most people don’t mind paying taxes, but they do mind that the taxes collected are mismanaged or not transparently handled. There are limits to individual freedom and ignoring the generally accepted rules of society is revolution, not freedom. Freedom is the ability or capacity to choose, decide and act according to one’s will, whatever it may be, and to bear appropriate responsibility for it. In fact, increasing freedom means changing the rules of society and the social contract.

Conclusion

Cardano, and all public networks in general, have the potential to increase our freedom. However, we need to think carefully about the specifics and then try to push these changes through from the bottom up. The people will be the ones who decide on freedom. Technology can only help them to do that, but it can do nothing on its own in terms of law-making and regulation.

Let’s not see decentralization only in the context of how decentralized individual blockchain networks are. Decentralization needs to be seen in the context of what inefficient and unreliable intermediaries it will allow us to replace and what benefits it can bring. Decentralized technologies will clash with centralized authorities and it is necessary to seek interconnections that are beneficial to all. Decentralization is a revolutionary concept, but its application at the societal level will be a gradual evolution. Slow evolution is certainly a better form of adoption than a sudden and turbulent revolution.

Myth-busting: the physical world is not a problem for Cardano

Myth-busting: the physical world is not a problem for Cardano Fees on the Cardano network

Fees on the Cardano network Sustainable decentralization

Sustainable decentralization What is a Fair Reward for Cardano Pool Operators?

What is a Fair Reward for Cardano Pool Operators?