Public networks differ from private networks in that the system features native coins. These coins have different meanings and functions for different public networks. One of the key features of coins is the reward for people who voluntarily keep the network going. This business is working well and people are economically motivated to maintain the network honestly. If the coins were to serve merely as a reward for keeping the network running, they would not be of interest to mass adoption. In addition to this primary function, however, coins may have secondary functions that determine their future price. Abilities of a network can also help significantly. A decentralized platform will be more useful than a simple transactional network. The secondary function of coins and network abilities are far more important than the primary function of coins for the future of the project. In this article, we will consider what additional importance can be given to project coins, how the network can contribute to it, and what will affect the growth.

Network and coins value

It is often said that cryptocurrencies have value. In this context, the value of coins that are expressed in fiat is mainly mentioned. Have we forgotten something? What is the value of the network? Coins without a network would not work. In the case of public networks, this also applies vice versa. A network without coins should have nothing to reward the people who run it. One cannot exist without the other.

The question arises as to how the network and coins influence each other in terms of price. As we indicated at the beginning, we are mainly looking for the secondary function of coins and network abilities. In principle, therefore, we can deal with the following two cases:

- Influence of coins on the network value.

- Influence of the network on the value of coins.

In the case of coins, the value is expressed by the market fiat price. In the case of the network, this is more complicated. We could easily say that the value of the network is expressed by the price of coins. However, this may not apply in all cases. The value or importance of a network will be definitely high if it is highly adopted. We can say that such a network is very socially important when it processes a significant amount of useful transactions. It can be true that the social importance of a network is high even if the price of native coins is low.

Interconnection between networks and coins is very important for investors. We will discuss the details further.

As you can see in the picture, network, and native coin values are linked and influence each other. Cardano network affects the price of ADA coins and vice versa. But let’s try to focus only on one side of the equation.

Why is the price of coins rising? Price is influenced by demand and supply. If we only look at it from the perspective of speculation, it is a belief in higher future appreciation or keeping the value in the long term. To make this happen, a high percentage of the population would have to trust coins. People would have to agree that, for example, a coin would be a store of value for them. In that case, it would make sense to hold such a coin in the long run. If we were to talk only about the transfer of value, it makes no sense to hold such coins. We would be exposed to an unnecessary risk of volatility. It would be enough to buy them for a short time because of the transfer of value and then sell them. In the case of value transfer, users do not need to care about the price to rise. It is necessary that the price does not change significantly during the transaction. A faster transaction is more secure since users can avoid volatility. On the contrary, in the case of the store of value, we want the price to be stable and rather to rise slightly, especially in the case of crises. So there must be a narrative that more and more people will gradually trust and believe.

However, this belief is entirely dependent on the quality of the network. Only the quality of the network gives the coins some real possibilities and usefulness. In terms of adoption, people can only trust coins but technically believe in the network. Only a network can ensure that coins continue to exist and give them unique features. So we get to the other side of the equation.

If people do not just speculate on the price and hold coins, they tend to hold the coins of the project they want to use. By buying and holding coins, people adopt a network. This increases the number of network users. The value and importance of the network increase with the number of users. However, the importance of the network does not always have a direct impact on the cost of coins. As we said, the value of the network can be significant in terms of adoption and social importance, but not in terms of coin prices. Adoption of the Bitcoin network through BTC coins means that people believe in the narrative of the store of value or future money. It can have a positive impact on the price that will tend to rise. Adoption of Ripple through XRP coins means that people enjoy using the network’s capabilities. Mainly fast and cheap transactions. The price of XRP does not necessarily have to grow. Do you see the difference?

Wait a minute, we have simplified it a bit. The adoption of Bitcoin is very low, so people generally do not believe it is a store of value. Moreover, you can use BTC only for the transfer of value. It often happens between business partners from different countries. In this use case, it makes no sense to be exposed to BTC volatility. A partner from Europe just buys BTC and sends it to China’s partner. China’s partner just sells BTC right away to keep the same fiat value. You could say that it is a typical use case for XRP. However, there are a lot of XRP holders. There is nothing certain in either case at this point of adoption. Let’s add, that volatility makes cryptocurrencies unsuitable for business and shopping.

Influence of network quality and properties on the price of coins

The direction of the network’s influence on the price of coins is much more fundamental. Network features and quality will play a major role in adoption and usage. This currently affects the cost and usage of coins. Network features have a direct impact on how people can use the network in real life. The network can also have an influence on the possible secondary functions of native coins.

Coins have two basic primary functions. It serves as a reward for people maintaining a network and it is their ability to be transmitted from address to address. Transfer of value differs significantly from network to network. We do not discuss primary functions in the article.

Let us stop for a moment with the network consensus and the economic model. These are key parameters for the network as they affect the security and long-term sustainability of the network. However, they also have an impact on adoption. Cardano is unique in that security budget scales with higher network adoption. Each ADA holder is granted the right to delegate a coin to the pool. This ensures passive income. PoS is in this much more interesting solution than PoW. The PoW network is very expensive to keep up and running, and all the reward is spent on paying for electricity. The Bitcoin network is not owned by BTC coin holders or miners. Miners only maintain it for a reward. It is only business and they cannot hold BTC coins. Moreover, BTC coins do not generate anything for holders. Holding ADA coins is more binding. People who want to maintain the network must necessarily own coins. In addition, all holders can participate in decentralization.

The basic feature of a network is to transmit value from address to address. Here we can talk about speed, price, and reliability of transmission. Obviously, it is preferable to use faster and cheaper transmission. A prerequisite for every transmission is that both parties use the same network. So it is about adoption. Each cryptocurrency network can transmit value so networks will compete with each other. It can be assumed that over time the most suitable network for this use-case will prevail.

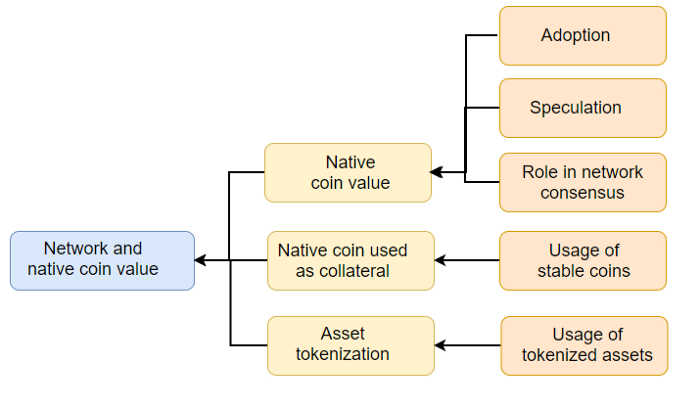

Network capabilities can give coins a secondary function. Cardano is a platform and allows the creation of a stable coin that can be backed by ADA coins. This is a huge advantage. The creation of stable coins and the possibility to transmit them increases the network’s importance. The network will have to ensure the existence of stable coins and protect the value. People will hold and use stable coins on a daily basis so stable coins must keep their value and cannot be lost due to possible network malfunction. Thus, the Cardano network will process more transactions and increase the volume of transmitted value. The network will not only transfer native ADA coins but also stable coins.

In times of gold standard, money was backed by gold. This is exactly what can be done on the Cardano network again. If there is a high demand for stable ADA-based coins, the pressure on the price of the ADA coins themselves will necessarily increase. In other words, there can be only as many stable coins as the ADA coins that serve as collateral. This can only be done because the Cardano platform allows you to write smart contracts. This makes it possible to add additional features and purposes to native coins.

There will be more platforms in the crypto-world that can do this. Again, it will depend on other network features that may affect adoption. Smart contracts and the programmability of money can be a powerful ability in the sense of platform adoption and stable coin built on it.

Tokenization increases the value that is protected by the network

As far as value transfer is concerned, we can talk about the volume of value transferred by a network expressed in fiat. The more value network stores or transmits, the more important and significant it is. Networks maintain the value of native coins, so the importance of the network increases with the capitalization of the project. Put it simply, the network protects higher wealth. All who hold ADA coins rely on the network and must trust it. As we have seen above, ADA-backed stable coins increase the value and wealth that the network must protect. We can say that a new valuable tokens were created. The Cardano platform can tokenize the money. Assets tokenization is another network’s feature that can increase the importance of the Cardano network. If we can tokenize stocks, commodities, goods, money, game items, property, human labor, and many other valuable things, all of this value will be created, transmitted, and protected by the Cardano network.

The tokenization of assets does not require ADA coins as the underlying asset. Here it is important to connect reliably to the physical world. For example, if shares are tokenized, there is no reason to exist in paper form. The stock can exist fully in digital form. The only obstacle is the current legislation, which varies from country to country. However, ADA coins themselves can be considered a new type of stock. ADA allows you to own part of the network and profit from using it. Most transaction fees will be paid to stakeholders. Switching to a tokenized form of shares will be difficult, but it makes sense. You can divide the tokenized stock into multiple parts, trade them 24/7, hold them anonymously, and they will be available to the whole world without legislative obstacles. It is only a matter of time before this happens.

Did you notice that we mentioned money once again? We can tokenize money in a way that real USDs are used as collateral. There must be a trusted third party that keeps USDs in a bank and create tokens with the equivalent value. Issued tokens are backed 1:1 by USDs. It is the case for USDT (Tether).

The Tether case is a different kind of tokenization from stable coins that are backed by ADA. Using ADA as collateral is a more decentralized approach.

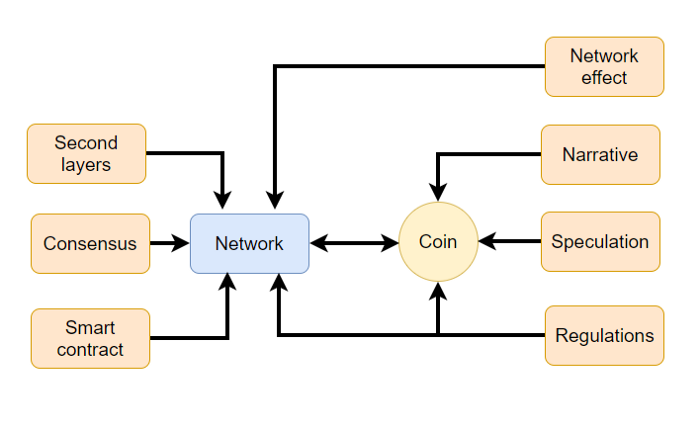

In the picture below you can see a few factors that influence the value of a network and native coins. On the left part, you can see the network that is mainly influenced by technological aspects. On the right part, there is a native coin, which is influence mainly by social aspects. Important is the arrow between the network and the coin. All aspects together play an important role in the adoption and capitalization of a project.

You can think about different projects and consider how to deal with these aspects. For example, Ripple openly calls for regulation and legal certainty. On behalf of Bitcoin, various financial institutions try to do so, as they can profit from it.

Value drivers of network and coin

Let’s have a look at an overview of all factors that can influence the price of the Cardano network and its native ADA coins. In one word, it would be real utility or adoption. The adoption is always for a reason. What can be the reason? As we said, it can be just a belief in some narrative or plain short-term speculation. In this case, adoption will be fully dependent on the number of adopters. If a certain threshold of adoption is not exceeded, the project will never become what early-adopters consider it to be. The narrative will not be believed by the majority of people. Fortunately, adoption is not just about narrative and strong stories.

Adoption through the usefulness of the project is a much more feasible direction. Network quality and capabilities play a key role here. If the project offers useful features, there is a good chance that people will use them. Adoption will grow with the usage of the network. Capitalization will grow with adoption. You can see in the picture that not only the native coins but also the secondary functions of these coins will affect the utility of the network. Further, asset tokenization can help. The IOHK team builds Cardano to be strong in all these factors. We think it will be a big advantage from the perspective of adoption. There are several factors that will individually contribute to adoption.

Let’s look shortly at other projects. The adoption of the Bitcoin network is based mainly on speculation and a strong BTC narrative. The first player’s advantage is significant but not necessarily sufficient in the world of technologies. Ripple network can send not only XRP. Banks can also send other tokens via the Ripple network. However, we do not yet see that Ripple should be able to tokenize assets or have created stable coins. Interestingly, XRP is not used in network consensus. Neither BTC nor XRP provides passive income to holders.

In our article, we did not mention the Ethereum, which is a direct competitor to Cardano. Ethereum has comparable capabilities to Cardano. The adoption paths will be the same. Platforms can co-exist and competition only benefits them. Each of the platforms is likely to occupy part of the market. Bitcoin, Ripple, and platforms do not compete directly with each other. Everyone goes on their own axis of adoption.

However, their paths may intersect. Bitcoin will be able to send Satoshi quickly and cheaply. Maybe we will see smart contracts in the future through a second-layer solution. Ripple also has a smart contract project. All digital assets can be used as a basis for stable coins. The question, however, is whether Bitcoin should also be a platform, as it would directly compete with existing platforms. This scenario is not very likely, and it might not help much to Bitcoin. Everything important would happen on the other layers anyway.

It may be interesting to speak about cryptocurrencies from the perspective of the store of value. Bitcoin is aiming at this goal. The question is whether the store of value can also become other digital assets. From our point of view, they can. If Cardano succeeds as a platform, ADA coins will have a role similar to shares. As long as the network is in use, the ADA coins will have value. Through coins, you own a Cardano network. Most transaction fees are given by the network to the stakeholder. One day, Cardano might protect and be transferring huge value.

Notice that without the Bitcoin network, BTC will have no value. Technology is always an important part of the world of networks. Cryptocurrency is where money and technology come together. Both components will influence future development.

Summary

The value of the network and the coins complement each other and rely on each other. Each of them helps adoption. Coins mostly in terms of price and adoption. Network mostly from the technological point of view and real usage. In our article, we wanted to outline different points of view. Cryptocurrency adoption is still very low, so you can’t tell what network properties and capabilities will ultimately prove essential. Every project has a great chance of adoption. Everyone follows their own path. The aim of the article was not to point to a winner. There will be more winners anyway. Finally, who is the winner? The project with the largest capitalization, or the project with the greatest adoption and network effect? We’ll have to wait for the answers.

Many people think that due to having Bitcoin, it makes no sense to work on another network. Bitcoin has no chance to absorb all the functionality and become a leader of innovations. At the moment, Ethereum has a much higher chance of adoption by the business and even by the users. Decentralized Finance (DeFi) clearly demonstrates this. Cardano stands next to the Ethereum. It is difficult to build any usable functionality on a Bitcoin network. But it doesn’t matter, Bitcoin isn’t here to become a platform. Ethereum had a lot of technological issues in the past and it makes sense to come up with the Cardano network that is based on scientific research and built as a mission-critical project.

If we look at projects from the perspective of adoption, we can see this. Bitcoin is most adopted, but its functionality is limited. Although it has been running for more than 10 years, it is not the best technology. It certainly makes sense to come up with a high-tech solution and try to push through. The adoption of Cardano will initially be low, but due to technology and usefulness, it can change quickly. Only the number of useful transactions counts. Platforms will always have a greater network effect than transactional networks. Usefulness will affect adoption and adoption will push for capitalization. There is a bright future for Cardano.

How far the price of Cardano´s ADA might go

How far the price of Cardano´s ADA might go Let's talk about the realistic market capitalization of Cardano

Let's talk about the realistic market capitalization of Cardano Can Cryptocurrency Affect My Credit Score?

Can Cryptocurrency Affect My Credit Score? Do People Care about Decentralization?

Do People Care about Decentralization?