What banks do

A regular bank can offer you many services. You can open a standard or business account. You can also open a savings account so you can increase the value of your funds. You can take different types of loans, for example, short-term, long-term, or business loans. You can also insure yourself or your property. You can save on your pension with a bank or other financial institution. Basically, you give your money to someone else who invests it for you. You can find other financial products on the market, but for the purposes of our article, we only need these.

Financial institutions need your identity, your payment history, and other information about your assets. A bank will offer you the best possible interest based on all this information. If you have a good payment history, reputation, and own several properties, you will get a higher loan and lower interest. This also applies vice versa. If the risk is higher, the interest rate increases accordingly. This is how it works in developed countries. If you have a negative entry in the register, you will probably not get a loan. Let’s add that in developing countries you often don’t even have a chance to borrow.

The bank is primarily a middleman, which always has enough funds for loans and profitable investments. Commercial banks manage people’s money and lend it to other people. Banks profit from all offered financial products. Banks and financial institutions have the right to hold and use our money for their benefit. They also have the right to lend and invest money. This right is guaranteed by the states. People trust banks mostly because the state and the legal system guarantee their fair behavior. Moreover, the state is often in a position to decide who can set up a bank and what conditions it must meet. Banks thus have a kind of monopoly on making money from citizens’ money. In addition, banks have the right to handle our personal information and monitor our transactions. They may even freeze some suspicious transactions and ask for details.

What current generation of cryptocurrencies are not able to do

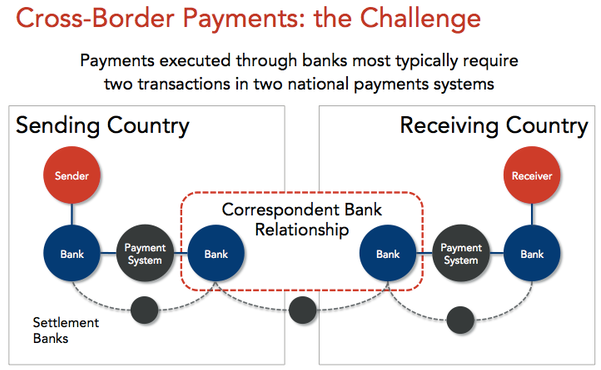

Today’s cryptocurrencies can do just one thing — sending transactions from Alice to Bob. Blockchain users can open their own account and send coins back and forth. It only works well between people who know each other and trust each other. This alone cannot threaten or replace banks. Banking transactions are very complex, especially cross-border ones. These transactions are slow, expensive and there is a high error rate. Some blockchain technologies are definitely a better solution. However, as we have seen above, the bank business is about something else.

If you need to send a transaction to someone you do not know, you run the risk that the counterparty will not meet its obligation. A typical example is buying goods at the bazaar. If you find a great guitar for a good price on the internet and pay the unknown seller first, the seller may not send you the promised guitar. If you fail to persuade the seller to send it to you, you will need to ask the legal system for help.

Do you know what you are missing in the above scenario? You are missing a trusted middleman. More specifically, you are missing someone who knows the exact terms of the transaction and decides what should happen if one party fails to meet the terms. You are missing a contract where the terms are clearly defined and a mechanism that would help with the execution. As you can see, current transaction systems do not cover all possible use cases.

Let’s have a look at whether it is possible to disrupt bank business. Imagine a situation where Alice lends Bob 1 BTC. Bob promises Alice to return 0.1 BTC each month until the debt is paid. Maybe it would work if Bob and Alice knew each other well. Alice can physically contact Bob and push him to pay the debt. If they don’t know each other and Bob stops paying off the debt, Alice can’t do anything at all. Notice that we are completely in the digital world and there is no connection to the physical world as in the example with the guitar.

If the bank lends you the money, there is always a paper contract between you and the bank. The legal system will help the bank recover the debt. Notice that the same legal system also protects you because the bank must act according to the rules set by the state or other authorities.

Bob can borrow money from the bank. Whether he trusts the bank more or less, he is sure that if he borrows and repays, nothing bad will happen. If Alice and Bob enter into a paper contract, the legal system will also protect both Alice and Bob. Making use of the legal system means that Alice and Bob need to provide evidence of everything that happened. The evidence will be, for example, a paper contract, bank transfers, emails, and claims of all participants.

The traditional system does not take into account the right to privacy at all. It is simply not possible to borrow anonymously. If a decentralized product could do it, it would have a competitive advantage. However, anonymity costs something. If you want to borrow anonymously, you must pledge the equivalent of the borrowed value. Crypto is quite popular as collateral. However, because it is volatile, you often have to provide collateral greater than you actually borrow. This will not suit people who have nothing to provide as collateral. These people can reveal their real identities, but still, they have to accept higher interest rates. They can ask a friend to provide something valuable as collateral and help them to get the loan. As you can see, it is a relatively complex financial contract.

There is another aspect. Privacy means that to prove an event might be complicated in the case of troubles. The privacy should work in a way that transactions and contracts are private but participants can still prove all details to a third party if needed.

What crypto must be able to do

To create an alternative to banks, blockchain technology must ensure the following:

- Play the role of a trusted middleman for participants who don’t know each other and thus do not trust each other. This can be achieved through decentralization. A decentralized network can act as a trusted middleman between parties. However, we need to combine decentralization with other capabilities to cover more use-cases.

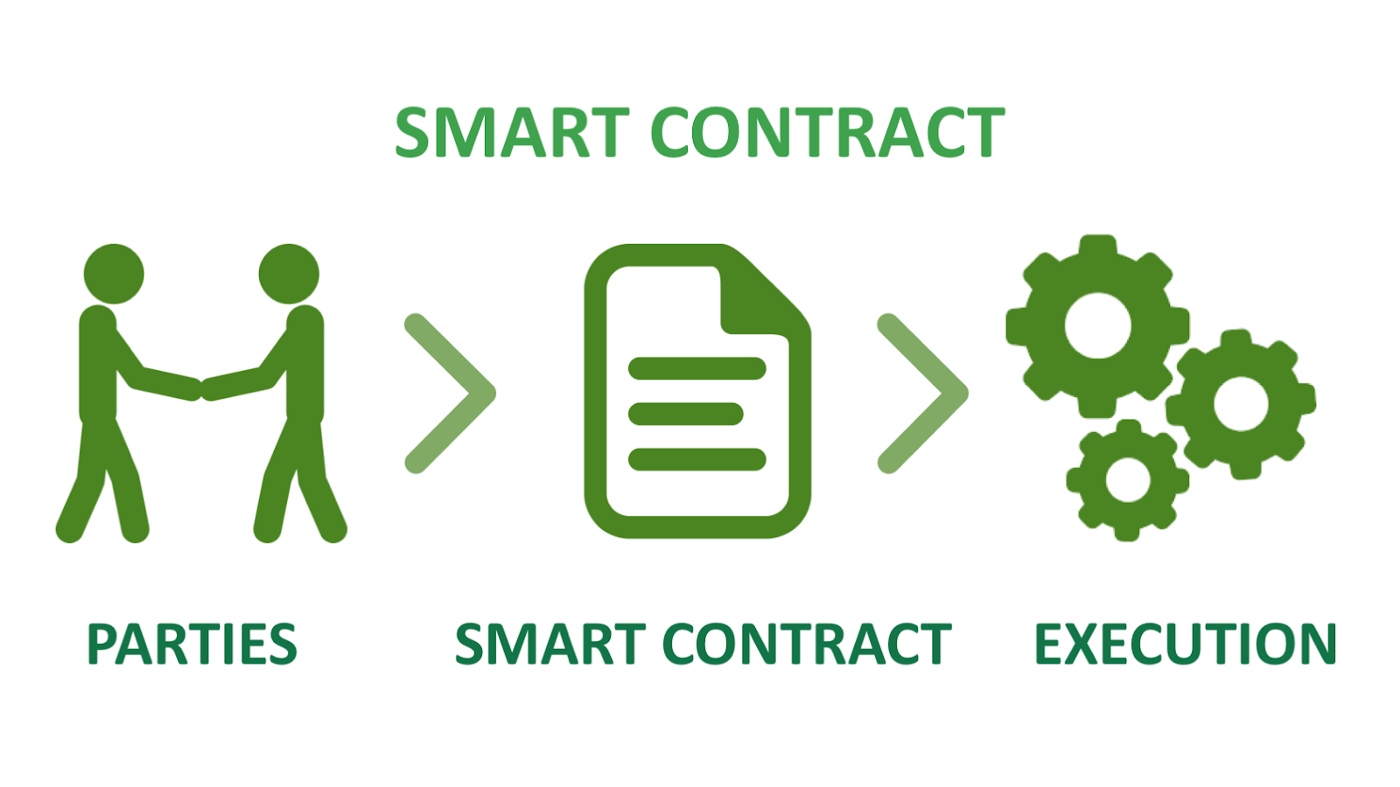

- Replacing the bank’s role means allowing participants to negotiate the terms of the contract. Luckily, we have already invented smart contracts. A digital form of contract. This will give context to transactions. Alice and Bob’s addresses will be part of the contract. The contract will be able to verify that Alice lent to Bob. Furthermore, the smart contract is able to verify that Bob repays the loan on time. Bob has to send 10 transactions to Alice to the same address. This is the necessary context of transactions for the contract. A smart contract is basically just a logic that expects some events to happen and act based on that.

- Replacing the role of the legal system means that the smart contract will make it possible to oversee the events associated with the agreement and to enforce some corrective action in case of problems. If Bob sends back only half of the debt and then stops paying off, the smart contract has to make things right. Part of the contract is also an event that occurs when Bob stops paying off.

Replacing the legal system is perhaps the most difficult part. But not necessarily. If both participants are to remain anonymous, Bob must pledge something precious in the value of the loan. For example, a Netflix annual subscription, a 1000-liter gasoline voucher, or another cryptocurrency. A smart contract can keep these things in custody and if Bob stops paying off, Alice gets those things. Possibly just part of them. There may also be a reputation system that will reduce Bob’s credibility. Finally, there is nothing to prevent the legal system from being used. If the real identity of participants is known, the smart contract can use it and reveal it to authorities. This is despite the fact that both participants were anonymous at the beginning. The system can ensure that they are both from a country where the same legal system applies. Thanks to the blockchain and other applications logic, all the necessary contact information, and related transactions will be put together easily. Once Oracles are part of the infrastructure, it will not be a problem to create the documents needed to contact local authorities.

Traditional paper contracts today are complex and well understood by only one party. Most contracts and all their details are more understood by banks and their legal department than ordinary people. Digital contracts could be much simpler. The source code of the contract could be translated into easy-to-understand sentences that everyone can easily understand. There will be no room for footnotes or unexpected unilateral changes during the course of the contract.

The transaction system, together with smart contracts, can replace some of the bank’s financial products and financial institutions. Working with debt can be relatively easy as everything happens in the digital world. Insurance can work similarly, but here, in most cases, it will require a connection to the physical world through Oracles. Oracles can provide information on the cost of assets, weather, aircraft arrivals, match results, and other things. One day we can see the current authorities, which is generally trusted. Alternatively, collective voting can be used. The interested group can vote on something and the result of the voting will be an event to which the smart contract will respond. It can also be a relatively reliable link to the physical world at the local level. Oracles and voting are not always necessary. We can imagine a solution that can largely work fully in the digital world. With the increasing asset tokenization, other options will be available. You can be insured in case someone does not send you Tesla shares in time.

What business and economy needs

The real economy needs to be able to work with debt. The payment system itself is only a tool that cannot spin the wheels of the economy. Some entrepreneurs work with short-term or long-term debt nearly every day. It is one of the reasons why we need banks.

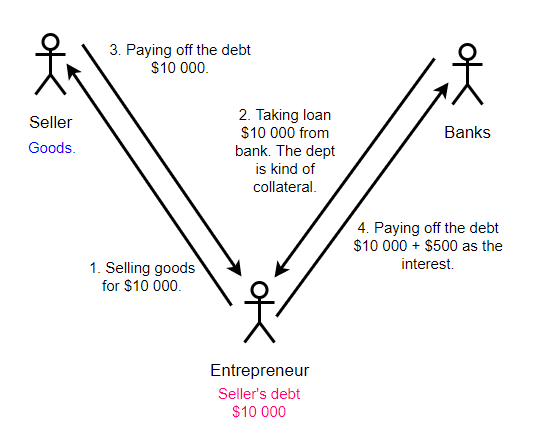

Imagine that you are an entrepreneur and you lack cash. You have sold goods to a seller. The seller will pay for the goods after one month. It is too long for you since you need cash for the business immediately. You have the seller’s debt. So you can take a short-term loan from a bank using the seller’s debt as collateral. Once the seller pays off the debt you pay off the debt to the bank together with the interest.

This is quite common in traditional businesses. Entrepreneurs often take a short-term loan and pay it off once the debt is paid off by the seller.

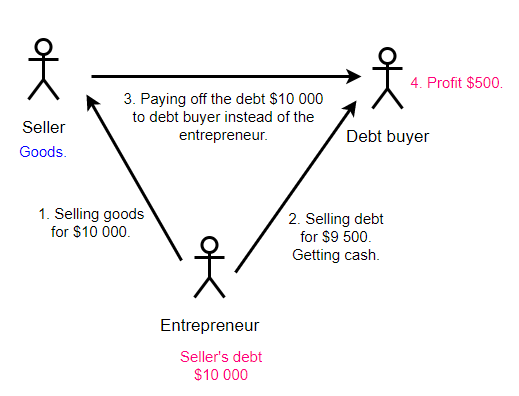

Is it possible to avoid banks? Yes, if there is somebody to take the risk and buy a debt. Let’s try it once again. You are an entrepreneur and you lack cash again. A seller owes you money for the goods you have sold him. You know that the seller will pay off the debt after 1 month. You can sell the seller’s debt and get cash immediately for your business. You sell the debt for a little less than its value to a debt buyer. The debt buyer will profit from it because he gets the entire debt from the seller.

It does not matter whether we call the buy of the debt a bank or debt buyer. It is someone who is willing to take the risk and profit in case everything goes well. It doesn’t even matter if we implement the first or second scenario via smart contracts. A simple version of the bank can be implemented via smart contracts. Important thing is that we used a complex contract between three parties in the scenarios where a debt can be used as an asset that can be sold. For that, we definitely need tokens and smart contracts and cannot achieve that with a transactional system.

There are many other types of debt in the real economy and many other reasons why we need it. For example, if you have a vision but do not have the resources to implement it, you must be able to borrow money. We must be able to create a system that can handle risk. For example, we need to combine risky contracts with less risky and treat it as one package of debts. If several contracts from the whole package are not repaid, only the yield will be reduced. So the impact will not be so drastic.

If we want to build an alternative economy, we must be able to finance things that must be financed collectively. A group of people must send funds to one address. From this address, another group of people or an individual will finance the construction of a cinema. Resources must be released in a controlled manner. People must be able to get funds back if construction does not start. Smart contracts are no longer enough for this. In this case, we also need some form of voting. Through the voting, it will be decided whether to continue with releasing the funds or whether the rest will be returned to those who have sent the money.

We need the existence of trustworthy middleman to whom we can entrust deposits and hope that they will increase the value of deposits through profitable financial activity. So basically what banks are able to do but in a fairer way. We need to invest money and save for retirement and it cannot be expected that all people on the planet want to do it themselves. These new decentralized financial services need to be more transparent, cheaper, faster, more accessible to all people without discrimination, protecting the privacy and, above all, well-secured.

Why Cardano

Cardano will be a social and financial operating system that will make it possible to build alternatives to traditional financial services. Cardano will scale sufficiently at the global level, will have secure smart contracts, will have a voting system, will work with Oracles and identity management. Cardano expands decentralization capabilities and gives context to transactions. This is a major shift in blockchain technology capabilities compared to the first generation.

It is important to realize that banks and IT giants can never deliver a blockchain product that would gain the same level of trust as public open permissionless networks. First and foremost, they are all technologically far behind, and catching up with Cardano can be hard for players like IBM, Google, and Amazon. But most importantly, if publicly known companies or institutions deploy a blockchain that they themselves control, people will not trust it. Even if they trust, sooner or later someone would misuse the position from the inside of the system.

If a blockchain is delivered by a bank or corporation, they will take care of the nodes that participate in the network consensus. So they will keep an important part of the control. For example, in the case of Libra from Facebook, nodes would be maintained by a consortium of companies. In public networks, a very important part is the incentive and economic model that motivates people to keep the network running. The control is thus left to the people. Everyone, including companies or banks, can operate the node. It is just about money and it cannot be prevented. Important is that institutions will never have full control over the network consensus. Moreover, once some network begins to be controlled by institutions people might start using another one.

Public networks maintain and keep running people for people. But also for small and medium businesses, banks, financial services, and states. Cardano offers an alternative that people can own. People will be able to build alternative financial and social services on Cardano and will demand that all other traditional services have similar parameters. Decentralized alternatives will push traditional services to use blockchain technology. People might require institutions to use a network they already trust.

And this is not just about network consensus. Cardano is open-source. Decentralization must also work well at the level of source code changes through decentralized governance. People will decide for themselves what the network can do and in what direction it will develop. Everything will be transparent and understandable.

There is yet another problem. If banks and institutions run their own private blockchain solutions, new information silos will emerge. Sooner or later it will be necessary to interconnect these silos. Linking can often be quite challenging. It would be much more advantageous if they all used one network. It is too early to say which network it will be, and there will be probably more candidates. However, institutions are also slowly realizing that launching a private blockchain only partially solves their problems. Moreover, China is about to launch a national digital currency. EU is considering that as well. There is a need to come up with some standards, and here public blockchains can play an important role.

Tokenization

Cardano will be able to issue tokens. A token can literally be anything. Such as concert tickets, meal vouchers, game items, magazine subscriptions, the right to use or consume a digital service. We can even tokenize assets that are used in traditional financial services. Tokens can be stocks, bonds, commodities, and many other assets. Tokens allow you to link existing services with blockchain capabilities. All this will make it possible to create brand new services and connections that may not even have come to your mind.

Here are some examples. How to ensure that you have identity while remaining anonymous? Well, let’s ask what is really important. Is it your name and address, or information about your hobbies, interests, economic and social activities? What if your identity contains information such as that you visit a local cinema and swimming pool or that you regularly have lunch at a local China restaurant? If you do this often, you have a local identity and you probably live in a particular city. The store may give you some discount on frequent purchases and may not know your real identity. It might work only with an address or some kind of ID. A cinema may want to let you know about new movies and pay for advertising directly to you, not to a middleman. If you want to borrow a small amount of money, you can offer a cinema subscription in return. A counterparty may have evidence that you are from the same city without working with your address. Modern cryptography is very powerful and allows us to create functionalities like this. There are no limits to imagination.

Do you remember buying a guitar at a bazaar? With smart contracts, there is a chance to make buying more secure. Payment must not be sent immediately to the seller but must be temporarily stored at an address under smart contract control. The smart contract then decides whether to return the payment to the buyer or send it to the seller. The smart contract can create a token to unlock the payment to the seller. The token can be used by the buyer to unlock the payment at the moment he takes over the guitar from the postman. Or the token can get a shipping service and also unlock the payment when the guitar is handed over to the buyer. It would be a better option that prevents the situation when the buyer would keep the guitar and does not unlock the payment. There are more possible variants.

Conclusion

Cardano will have so many useful capabilities and functionalities that it has the potential to disrupt traditional financial and social services. This will take some time. First, the platform must be adopted by the developers, doing some experiments and tests. Once adopted, we will see many new applications and services. Then can people enjoy new possibilities and see if they are better and more beneficial than traditional services. We’re looking forward to it.

Source: How Cardano can disrupt the traditional financial system

Cardano builds Strong Community

Cardano builds Strong Community Cardano can bring stability and reliability to the World of DeFi

Cardano can bring stability and reliability to the World of DeFi Is Cardano the biggest innovation after the Internet?

Is Cardano the biggest innovation after the Internet? Security budget of the Cardano project

Security budget of the Cardano project