Satoshi Nakamoto created Bitcoin and silently left at the end of the year 2010. It is believed that he had no influence on Bitcoin development and public sentiment after his leaving. Bitcoin maximalism appeared somewhere in 2014 and completely twisted all Satoshi ideas. We think that Satoshi would not agree with Bitcoin maximalists. It is needed to take a step back, have a look at what Satoshi wanted to give us and build on his visions. Maximalism does not help us in the effort to decentralize the world.

Note that the article is not about pro-bitcoin people or investors generally but about Bitcoin maximalism. Authors of the articles are fans of both Cardano and Bitcoin. Take it easy.

What is Bitcoin maximalism

Bitcoin maximalism is essentially the idea that it is undesirable to have multiple competing cryptocurrencies. Trying to succeed with another project is a silly and needless attempt since Bitcoin is going to dominate the world and take a monopoly position absorbing all functionalities. Bitcoin maximalists argue that Bitcoin has the biggest network effects and claim that it is futile trying to overcome that.

Some Bitcoin maximalists might admit that Bitcoin has issues with scalability, there are no plans to have smart contracts in the first layer, and some critics do not consider Bitcoin as a properly decentralized cryptocurrency. Pretending not seeing that, they still believe that there will be a point in the future at which the bitcoin network provides everything that investors want to have in digital currency.

Nowadays, maximalists claim that every effort or project that is not related to Bitcoin is a scam. They say it without any attempt to analyze the project, checking GitHub activity, reading a white paper or anything that would give some value to their words. Generalization is a very silly and bad approach and nearly always does not work.

Maximalists' claims are often out of rationality. They are able to tell you following nonsenses:

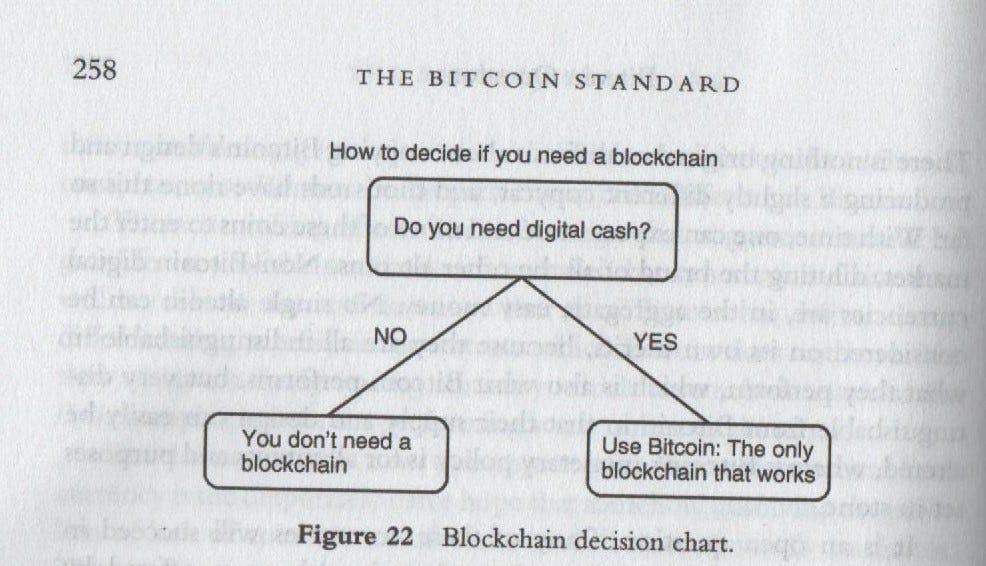

- Blockchain is a slow and inefficient database and it cannot be used for anything else than Bitcoin. It must be like that forever and it cannot be improved.

- PoW is the only working consensus. Nothing better can ever be invented. PoS is bullshit and can never work. No PoS project runs.

- Bitcoin is not a blockchain.

- Or the other way round, only Bitcoin is a blockchain.

- Bitcoin is not a technology.

- 21M coins and Bitcoin’s inflation model based on halving planned for every 4 years is the best monetary system ever.

- Satoshi left the project what is the best approach and every project with pre-mined coins must be a scam. A team does not need a leader.

- Smart contracts are nonsense because of all ICO’s are scam.

- Bitcoin can absorb every technology and will be able to do everything in the world.

- Everybody will use Bitcoin one day. It is the new money of the universe. It is better than gold.

- Bitcoin is the most decentralized project. It does not matter that there are pools and big mining farms.

- Security is the top property. Decentralization and even scalability are not so important. Bitcoin scales just well and Lightning Network solves everything.

Do you agree with any statement? Then you might be a maximalist.

In our article, you can read what blockchain exactly is. You could be surprised that Satoshi never used the word. Blockchain really is a technology and can be used in other projects.

You would be probably able to find many other smelly claims. Let’s try to debunk it a bit. We do not want to disprove all the above claims one by one. It is better to have a look at what Satoshi left behind.

Satoshi’s vision, maximalists view, and the reality

Satoshi achieved something significant. He created Bitcoin so we can consider him as an inventor or person who desired to deliver a decentralized form of money. He had a lot of visions that we can easily find since there are available a lot of email communications and posts. Let’s have a look at a few pieces of his ideas and thoughts. We add some comments.

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts.”

Satoshi wanted to fight against inflation and wanted to create an alternative to fiat currencies that would allow avoiding the whole banking system. He did not like the fact that we basically have to trust banks and they misuse their position.

He did not want to create a digital gold or profitable project that would make him rich and famous. I refreshed the decentralization ideas, took into account all previous attempts, and deliver Bitcoin to show us that it is possible to build a decentralized network.

Satoshi has never written that Bitcoin is the only possible solution to the problem. He just wanted to create an alternative and he would probably like the idea that there are competitive projects trying to achieve the same. Sure, Satoshi, like everybody else, would not like scammy ICO projects. However, he would probably embrace the effort of people trying to build other alternatives. As you will see below he was not sure whether Bitcoin could succeed. However, he presumed that in 10 years after his leave we will use digital currency in some form.

“I would be surprised if 10 years from now we’re not using

electronic currency in some way, now that we know a way to do it

that won’t inevitably get dumbed down when the trusted third party

gets cold feet.

It could get started in a narrow niche like reward points,

donation tokens, a currency for a game or micropayments for adult

sites. Initially, it can be used in proof-of-work applications

for services that could almost be free but not quite.”

At the moment we can say that Satoshi's vision did not come into reality. Bankers are even richer than they were in 2008 and the majority of people use banks as before. Even Bitcoin maximalists have to still use banks or the current financial systems in some way. When you pay in a shop by bitcoin then it has to be converted to fiat. Maximalists might possibly hold only bitcoins to avoid touching fiat. However, fiat must be used to buy goods.

To be able to use a global public distributed network for the creation of digital money we would need to resolve the scalability issue. Satoshi did know that Bitcoin is not able to scale well but at that time he had no solution for that. It could be presumed that Satoshi would welcome every attempt to resolve the issue.

Lightning Network (LN) is a rather centralized network so why not welcome any other serious project building a scalable blockchain. PoW is strong in security but it will never scale. Why to generally refuse any attempt to build another scalable blockchain if it could be more suitable for building decentralized digital money? Networks might be easily interconnected. Bitcoin with everything else. LN is basically a separate network with its own nodes, addresses, principles, etc. It is just dependent on Bitcoin as a first layer. Instead of LN, we can use another scalable blockchain and it could be a more decentralized solution.

Should we use a centralized infrastructure like Lightning Network for decentralized Bitcoin? Is not it better to strive for building a decentralized public distributed network? Maximalists would a priori refuse the second option. However, it is quite clear that the decentralized infrastructure is more secure, safer and reliable than LN. From the user perspective, it does not better whether we will use BTC, ADA or anything else.

Satoshi expected that it could be hard to adopt something brand new and consider it as a currency. Bitcoin should have been used as currency in games, reward points or payment for adult content. Something, that is close to fiat currency, it is used as fiat currency, but it is not real fiat. He probably expected that the value of bitcoins will be very low at the beginning. Satoshi has not estimated the evolution well. Bitcoin is not considered as money but the current narrative is about storing value and it is often compared with gold. In our view, it is not so easy to create a digital gold.

It is difficult to say what Bitcoin exactly is. If you ask 10 persons they can give 10 different answers. It resonates around these possibilities:

- Store of value.

- Digital cash.

- Speculative investment or just investment.

- Gambling.

- Ponzi or pyramid scheme.

- Protest coin.

- Transaction network with utility token.

- Future of money.

- Nonsense consuming a lot of energy without any utility.

- Some combination of that.

If you consult the topic with maximalists they just tell you that it does not matter that it is not possible to find an exact definition. They are just pretty sure that the price will rise because of coins scarcity and institutional interests. They overestimate the current adoption.

Maximalists think that people ignoring Bitcoin are blind and do not see the potential. They will regret one day that they have not bought a piece of Bitcoin. Maximalists are sure that it must happen since it is a new form of sound money and fiat currencies will die. They, as early adopters, will be incredibly rich. Maximalists are not able to admit any other future alternative to their dream scenario.

Well, nobody can predict the future. The form of adoption where late adopters are fine with buying more and more expensive pieces of Bitcoin knowing that early adopters own tens, hundreds or even thousands of coins, is just unrealistic. It can be perceived as a form of a pyramid scheme and some economists speak about that. Maximalists just simplify reality and do not count on with real humans behavior.

“Announcing version 0.3 of Bitcoin, the P2P cryptocurrency! Bitcoin is a

digital currency using cryptography and a distributed network to replace

the need for a trusted central server. Escape the arbitrary inflation

risk of centrally managed currencies! Bitcoin’s total circulation is

limited to 21 million coins. The coins are gradually released to the

network’s nodes based on the CPU power they contribute, so you can get a

share of them by contributing your idle CPU time.”

Satoshi assumed that it will be easy to obtain a few coins just by participating in the network consensus. Nowadays, idle CPU time cannot earn you any bitcoin. He could not expect that ASIC miners will be needed for mining and the cost of electricity will prevent profitable mining in some countries. Nowadays, it is safer to buy bitcoin than to take a risk and mine it.

Satoshi wanted to create an easy way how to get a bitcoin without directly buy it for fiat. Satoshi did think about adoption and wanted to cheaply distribute coins to as many people as possible within a few years. The reality is that people interested in mining has to invest in ASIC miners and calculate profitability. It is more a business than something that everyone could easily do. As a result, after 10 years the adoption is very low and there is a lot of whales.

Satoshi replied to Hal Finney:

“ Hal Finney wrote:

> You mentioned that you are working on an implementation,

> but I think a more formal, text description of the system would be a

> helpful next step.

I appreciate your questions. I actually did this kind of backward. I had to write all the code before I could convince myself that I could solve every problem, then I wrote the paper. I think I will be able to release the code sooner than I could write a detailed spec. You’re already right about most of your assumptions where you filled in the blanks.”

As you can see Satoshi created a working prototype before he wrote the Bitcoin white paper. If you check other emails or posts you will find that Satoshi strived a lot to get Bitcoin working. He needed to see the network running to believe that the project is viable. It is great that the Bitcoin works. However, it is not very efficient and decentralization decreased due to the existence of pools and mining farms. As we have already mentioned there is also the issue with scalability.

Bitcoin can be used by a few individuals but obviously it is not usable for masses. It is true that even Bitcoin can be improved. The question is whether it is not easier to build a new better-designed network. Maximalists have invested in Bitcoin and wanted to be rich. They have skin in the game. It is evident that they are against all attempts to compete with Bitcoin. From the technological point of view, it just makes sense to build many networks, use them and find to best one in the open market. There is no reason to stick to Bitcoin just only to make a few Bitcoin early adopters rich if we are able to build a much better network.

Bitcoin was the first one and has the biggest network effect but it does not necessarily mean that it is the best network we can have. The reality is that we will be able to create a significantly better network every few years. Every team will have to make improvements constantly to keep the network relevant.

“ When that runs out [network subsidy decreasing by halving], the system can support transaction fees if needed. It’s based on open market competition, and there will probably always be nodes willing to process transactions for free.”

Satoshi expected that when network subsidy will be at a minimum level after a few halvings then there could be some nodes willing to run the network for free. The assumption could work if there is a properly decentralized network and a random node could mine a block. Nowadays, blocks are mined only by a few pools and there are big mining farms. We can hardly imagine that the network will be maintained just by a few nodes and will be resistant to the 51% attack. Moreover, Bitcoin is considered as digital gold by the maximalists so the hash rate should be quite high to protect the network.

Satoshi wanted to implement functionalities that would allow using cryptocurrencies for buying goods on the internet.

“ Here’s an outline of the kind of escrow transaction that’s possible in software. This is not implemented and I probably won’t have time to implement it soon, but just to let you know what’s possible.

The basic escrow: The buyer commits a payment to escrow. The seller receives a transaction with the money in escrow, but he can’t spend it until the buyer unlocks it. The buyer can release the payment at any time after that, which could be never. This does not allow the buyer to take the money back, but it does give him the option to burn the money out of spite by never releasing it. The seller has the option to release the money back to the buyer.

While this system does not guarantee the parties against loss, it takes the profit out of cheating.

If the seller doesn’t send the goods, he doesn’t get paid. The buyer would still be out the money, but at least the seller has no monetary motivation to stiff him.

The buyer can’t benefit by failing to pay. He can’t get the escrow money back. He can’t fail to pay due to lack of funds. The seller can see that the funds are committed to his key and can’t be sent to anyone else.”

To implement the above-mentioned functionality, a kind of escrow transaction is needed. Satoshi just wrote it since he expected not to have enough time to bring it into life. Today, we know that we can easily implement the functionality via smart contracts. The bitcoin team has not come with some solution in the last 10 years.

Maximalists often openly hate every smart contract platform despite it could fulfill one of Satoshi's visions. Would Satoshi hate it as well or would he be happy that there is a solution? The latter is more probable. Maximalists claim that Bitcoin can absorb any useful functionality but we do not see that happening despite the fact that decentralized finance (DeFi) grows every day. When does the Bitcoin team notice it?

If there is no competition then there would not be any technology that Bitcoin could absorb. It is healthy to have more projects trying to deliver some original functionality, test some concepts, or resolve some difficult IT problems. One day there will be many technologies and Bitcoin either adopt it or people will use it within different projects.

What Satoshi wrote about consensus:

“The proof-of-work chain is a solution to the Byzantine Generals’ Problem. I’ll try to rephrase it in that context.

…

The proof-of-work chain is how all the synchronization, distributed database and global view problems you’ve asked about are solved.”

PoW solves the famous Byzantine Generals problem. PoW is not the only solution to that problem and nowadays we know that PoS can solve it as well. The Cardano team did research to mathematically prove that we are able to build a PoS consensus that will be secure as PoW, more scalable, more decentralized and consume much less energy. It is great, is not it? Satoshi would be happy that we can have a scalable decentralized distributed network. Who knows, maybe Satoshi would be shocked how much energy Bitcoin consumes and he could want to replace the consensus.

Maximalists search for nonsense reasons to prove that PoS can never work. They are not willing to admit that the best brains in the world try to resolve all technical issues. They can check the IOHK library where they could find many scientific studies related to Ouroboros PoS.

Instead of reading it and use some ideas in Bitcoin maximalists just ignore it and call Cardano scam. Would Satoshi do it? Probably not. He would be interested in it and probably read studies with enthusiasm.

Satoshi was wrong nearly about everything we have discussed. It is just fine. It is difficult to estimate how things develop when you create something new and so far not used. The most valuable thing he gave us is the idea that we can dream about the decentralized world. It does not matter whether Bitcoin will be there in the next 10 years if the idea survive and we will continue with the effort. We can do it with or without Bitcoin. It does not matter what maximalists think about it. It is quite usual to be inspired by some work or idea and continue with own project.

Critical thinking

Bitcoin maximalists lack the ability to use critical thinking. To understand Bitcoin properly from the technological point of view one should be an IT specialist. Maximalists often are not experts in IT. It should be noted that some economical education is also useful. However, everybody should be able to use critical thinking or common sense.

Critical thinking is the analysis of facts to form a judgment. The subject is complex, and several different definitions exist, which generally include the rational, skeptical, unbiased analysis, or evaluation of factual evidence. Critical thinking is self-directed, self-disciplined, self-monitored, and self-corrective thinking. It presupposes assent to rigorous standards of excellence and mindful command of their use. It entails effective communication and problem-solving abilities as well as a commitment to overcome native egocentrism and sociocentrism.

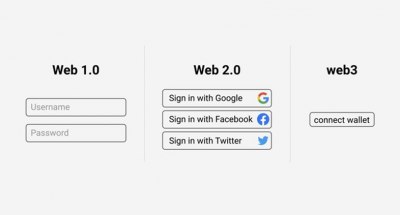

People should not take over public opinions without own thinking and should try to make a different opinion without fear of constantly changing it as new facts appear. Cryptocurrencies are a new area and everything is changing nearly every day. Only a few people wanted to create an alternative form of money before Satoshi invented Bitcoin. Now, there is a lot of teams trying to push technology further and solve difficult cryptographic, network, consensus and other technological problems.

It is true that many post-Bitcoin projects failed for many reasons. However, not all of them. We can see Ethereum, Ripple, Stellar Lumens and others that exist for some time and people use them. And new projects, like Cardano, will come to continue with the effort and offer a better technological solution that will be usable for masses.

Bitcoin maximalism is dangerous

Bitcoin maximalism could seem funny at the beginning but it causes a lot of damage and toxicity in the crypto-space nowadays. They are even books claiming that Bitcoin is a kind of standard and there are a few active influencers with many followers who just parrot their nonsenses.

If a new adopter comes to crypto it might experience a very unhealthy atmosphere, hate, and articles full of ideology. People can generally hardly adopt something from the space where there is so much toxicity, scams, hoax, hacked exchanges, and strange individuals claiming obvious nonsense.

There is a lot of Bitcoin forks and disputes between maximalists and Roger Ver, Craig Wright and others are really disgusting. People might think that Bitcoin believers are just gang of strangers or lunatics hating everything around them including fiat currencies, politics, and all competitors.

The crypto community must support all relevant projects and build a network that will serve all of us. Crypto must be attractive not only for investors but also for common people wanting to use modern technology without price speculation. Investors just want to persuade others that their project is better than all competing ones and they often do it inappropriately. It is basically only about money. We need to build something usable and valuable. Many people might have different opinions on that so it is just fine to have more competing networks. It is fine to compare them and highlight some advantages. It is dull to select one and make a fetish from it.

Future of money

Project competition is actually very healthy for the whole market. Scams will disappear and solid projects will stay to serve people. The free market will decide what we use and for what. Do we use a decentralized store of value, or rather digital cash, or smart applications? We do not know yet, or to be more precise, the majority of people have not made the decision. We have just started and still do not have any viable network that would be able to serve the whole world.

Bitcoin was made as a protest coin but governments are not probably going to prohibit it. They just want to regulate crypto so we need mainly functionality and scalability. Not just the PoW project unable to scale. As we said, everything changes every day and the ability to react to that and listen to user wishes is the key to success.

Cardano is built to be ready for business and mass adoption. It will offer cheap and fast transactions, high scalability and programmability. New digital assets can be created on Cardano and all that hand in hand with regulations. Still, offering privacy and the ability to bank the unbanked.

Cardano is a high-tech project with a very strong team full of researchers and scientists. The team is able to deliver the best form of the distributed network. It is just common sense. The team is real and the effort as well. There is no reason to try not to see it or deny the facts. Like it or not, Cardano is here to stay.

Cypherpunk manifesto

Cypherpunk manifesto was written in 1993 by Eric Hughes. If you read it you will find that it is mainly about privacy. The word “money” is mentioned there only once:

“We the Cypherpunks are dedicated to building anonymous systems. We are defending our privacy with cryptography, with anonymous mail forwarding systems, with digital signatures, and with electronic money.”

https://www.activism.net/cypherpunk/manifesto.html

Satoshi Nakamoto was very probably inspired by cypherpunk ideology and worked on digital money. Bitcoin can probably never be private on the first layer so it is questionable whether it can be sufficiently private on second layers. Bitcoin had to have an open ledger to be trusted at the beginning. Nowadays, privacy could be introduced to fulfill the cypherpunk’s vision.

Note that the vision is not about the price speculation, institutional investors or getting rich quick. Some people are missing the point if they care only about the always rising price. The important is what technology can do for all people around the world. Not what it can do for the early adopters.

Bitcoin is a kind of protest coin and as such, it can never be adopted. What if we can use a decentralized and scalable project that is regulated at the same time? Could it work? Yes, definitely. There are many groups of people that require different features and the level of regulation.

Conclusion

Bitcoin maximalism has nothing to do with the original forms of cypherpunk and Satoshi vision. It is completely something different and normal people will probably tend to avoid the whole crypto if maximalism prevails.

It is very sad since we loose what we need the most. Adoption. We need new people and they need usable services and alternatives that just works. Bitcoin is not going to absorb everything since it is technically impossible. That is just a myth and maximalists even do not want to absorb all functionalities. They just want to have Bitcoin as is with minimal or none changes. Good for them.

Cardano is a solid project trying to solve blockchain trilemma. If Satoshi could speak he would probably love and support the project. Maybe even cooperate with the team or use some functionalities to improve Bitcoin. Are we mistaken? We do not know. Take it as an alternative view on the thing.

Source: Satoshi would like Cardano and refuse Bitcoin maximalism

Cardano is the highest-ranking crypto brand

Cardano is the highest-ranking crypto brand The mission is the best thing on Cardano

The mission is the best thing on Cardano Cardano will have a new Lace wallet

Cardano will have a new Lace wallet Cardano is designed for mass adoption from scratch

Cardano is designed for mass adoption from scratch